TradeQuantiX Portfolio Update: 5/14/2025

Systematic Trading Portfolio Updates and Trading While Traveling

Welcome to the “Systematic Trading with TradeQuantiX” newsletter, your go-to resource for all things systematic trading. This publication will equip you with a complete toolkit to support your systematic trading journey, sent straight to your inbox. Remember, it’s more than just another newsletter; it’s everything you need to be a successful systematic trader.

Introduction:

It’s been a minute since I’ve written a portfolio journal, so I figured it was about time to write another. This will be a quick one, but I’ll give an overview of a few things going on with my portfolio and life since I last checked in. This article will cover the following:

Portfolio Performance

A New Trading System

Trading While Traveling

Here we go, let’s dive in.

Portfolio Update: 5/14/2025

When I last logged a portfolio update back in February 2025, I was at all-time highs. Since then, I’ve been sitting in a drawdown. I hit an equity peak near the end of February, then the drawdown set in. It makes complete sense why I’m in a drawdown; a lot of my strategies are long momentum-based. When the general stock market sells off like it has the past couple of months, my portfolio is going to feel a little pain as well. The goal is to have more gains and less drawdown than the general stock market over the long term. If I can do that, I’m a happy trader; and so far so good! Check out the plot below for my portfolio performance:

While drawdowns aren’t fun, they’re part of the game. On the other side of each drawdown is an all-time high. The longer I sit in a drawdown, the closer I am to new highs. This is how I frame the concept of drawdowns in my head—it helps keep me sane. Keeping your sanity is how you stay in the game to trade for the long term, so please, do what you have to do to keep your sanity!

With that said, my equity is quickly crawling back toward all-time highs. It seems like after each drawdown comes a rocket-like recovery, so let’s hope this time is no different.

It’s always important to zoom out, too. When I run my portfolio back to the year 2000 until today, the most recent pullback is nothing but a little blip on the equity curve. Check out the very top right corner of this portfolio equity curve—that’s what I’m experiencing right now. Doesn’t seem like that big of a drawdown anymore, does it?

As a side note, the past few months of my life have been pretty busy, which is both good and bad. It’s good because it distracts me from thinking about how I’m in a drawdown. It’s bad because it takes time away from system development and portfolio improvement. Can’t win them all—I just do what I can when I can. I’ve been working on building the habit of consistency. I try to spend at least 30 minutes a night on some activity that could improve my portfolio in the long run. While 30 minutes a day isn’t much, over the course of a year, that’s a lot of work completed. Sometimes I have to remind myself of that when I feel like I’m making zero progress due to being busy. As long as I get those 30 minutes in, that’s all I need to make progress (though I’ll do more if I’m able!).

If you missed the last portfolio update, you can check it out here:

A New Trading System:

As any systematic trader who has attempted to build a few trading systems knows, 95% of trading system ideas turn out to be poor systems. I test out new ideas all the time; most of those ideas are poor, and the systems get thrown in the garbage bin. But sometimes, an idea turns out to be a decent one.

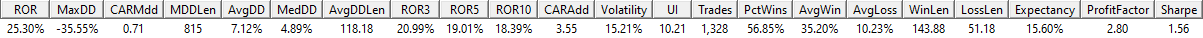

Recently, I’ve stumbled across a new trading system idea that I’ll likely add to my trading portfolio. I still have to do some more work to ensure it’s robust, but assuming it passes, I’ll be adding it to my collection of systems in the portfolio. At a high level, the system is a long term trend following system (which I also refer to sometimes as time series momentum) on the Canadian stock market. The performance looks super stable over time, and the system-level stats don’t look too bad either:

My favorite part of the system is that it’s super simple. The system only has a handful of rules, and they aren’t that complex. Also, the system works on other stock markets as well, such as the Australian stock market, shown below:

I love when systems work on multiple markets. It’s like a two-for-one. I could trade this system on both markets and benefit further from market diversification. I’ll be sure to share how the overall portfolio looks once this system is added to the mix!

For deeper learning opportunities in systematic trading, click the link below to schedule a free 30 minute consultation with me! During the consultation, we'll discuss your specific systematic trading goals and create a tailored plan to help you achieve them. 👉[Click here to book a free 30 minute consultation!]👈

📈 If you’re passionate about systematic trading and seeking guidance toward success, I can help!

🥇 I’ve worked as a systematic trading consultant for a private trading community for over 2.5 years, successfully helping more than 100 clients achieve their trading goals.

🚀 Now, I’m launching TradeQuantiX Consulting Services, offering personalized one-on-one coaching to help you master the intricacies of systematic trading.

📚 To learn more, click the image below to visit my website. There, you can book a free 30-minute introductory session to discuss how I can help you succeed as a systematic trader.

Trading While Traveling:

I just got back a couple of days ago from a trip to New York City. I had never been before, so it was a vacation to check out the city, eat some good food, and visit some family that lives in the area. Of course, it rained almost the whole time I was there, but the overcast did make for some pretty cool pictures:

Obviously, I had to keep up with my trading while I was traveling. That means waking up a little earlier to update my data, run my trading systems, and place the orders. Part of being a systematic trader is being consistent every day, even if you don’t want to. Remember, this isn’t a hobby—this is a business, and it should be treated as such.

There was one day that was pretty annoying. I woke up, cracked open my laptop, and began my stock price data download as I normally would. So far, so good. Once the new stock price data was all downloaded, I kicked off the batch script I have that runs all my trading systems. For whatever reason, on this one particular day, this script kept dying and disconnecting from the drive account where I keep everything stored. I would check on my computer every 5 minutes or so just to find the batch script had died. I would look into why it died, implement what I thought was the fix, then restart it. Five minutes later, it died again. This happened three or four times. I was frustrated—it was getting close to the market open, and I didn’t have all my orders for the day generated yet. I finally ended up getting all of my systems run and orders submitted about 15 minutes after the market opened.

I hate placing orders late. In my eyes, placing late orders is a mistake and potentially eats away at expectancy. I did what I could to avoid it and fix the issues, but on this one day, it wasn’t quite enough. These are the difficulties that come with traveling sometimes. No matter how prepared you think you are, something unforeseen will happen and throw everything off. It’s annoying, but that’s life. This is why 99% of the time we have to be on our A game and be perfect with our execution, so for the 1% of the time when something goes wrong, we can survive the extra costs that may occur (due to extra slippage from being late to execute orders or having poor execution).

If you’re interested in my systematic trading while traveling setup, let me know—I can write an article explaining exactly how I do it!

Conclusion:

Well, that’s the latest on the TradeQuantiX portfolio and life as a systematic trader. Drawdowns suck, but they’re just speed bumps on the road to new highs.

I’m pretty excited about this new trading system—fingers crossed it holds up to my robustness checks and adds some extra performance to my portfolio.

Trading while traveling can be a pain in the neck, but it’s all part of being a systematic trader who treats trading like a business. Sometimes you just have to roll with the punches, stay consistent, and keep your eyes on the long game.

I’ll keep moving forward and trying to improve every day, 30 minutes at a time (and probably cursing at my laptop when scripts crash again).

Stay tuned for the next update, and if you have questions or want me to dive deeper into anything, let me know!

Do you have ideas/suggestions for future articles? Let me know what you want to read about by clicking the button below and submitting your suggestions. Your suggestions are greatly appreciated as they help tailor this newsletter to what you want to read about.