Introduction:

I haven’t written a portfolio update in a while. I have been busy with holidays, work, travel, and other trading-related activities the past few months. So today I will update you on the portfolio performance, traveling while trading experiences, some interesting trading/investing conversations I was involved in, and some pretty darn near perfect trades my systems placed recently. In case you need to catch up, the previous portfolio update is linked below:

Portfolio Update: 2/17/2025

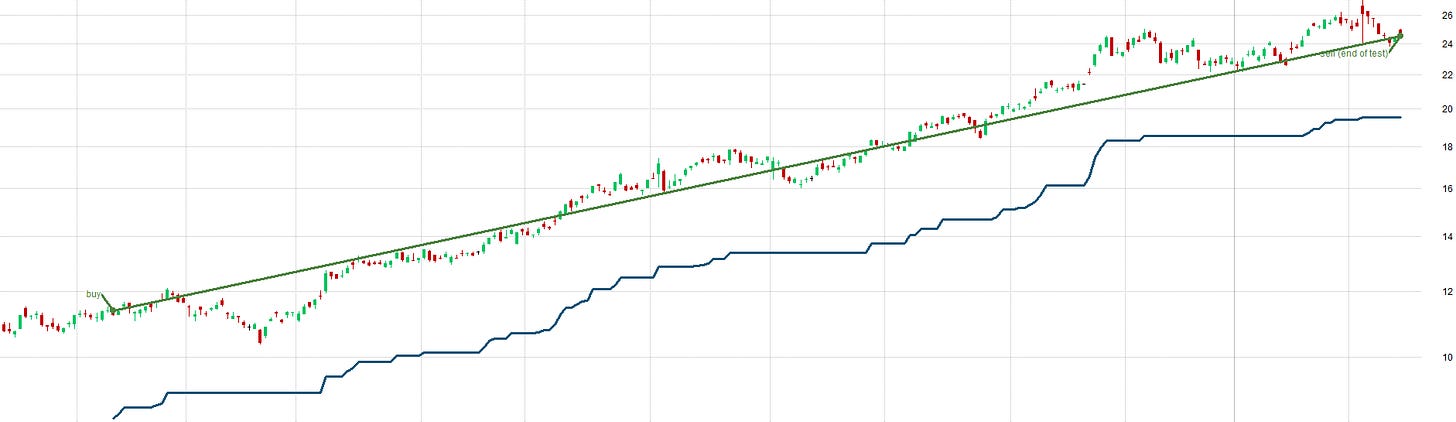

The portfolio is still behaving as expected and has performed decently well so far in 2025. The markets have experienced a little sideways action and mild volatility, but the TradeQuantiX portfolio decided it didn't want anything to do with that. Happy to see new highs in the portfolio equity after some sideways chop between September 2024 and mid-January 2025. You have to embrace the chop; you spend more time with your equity being chopped around than increasing in value. See the portfolio performance plot below.

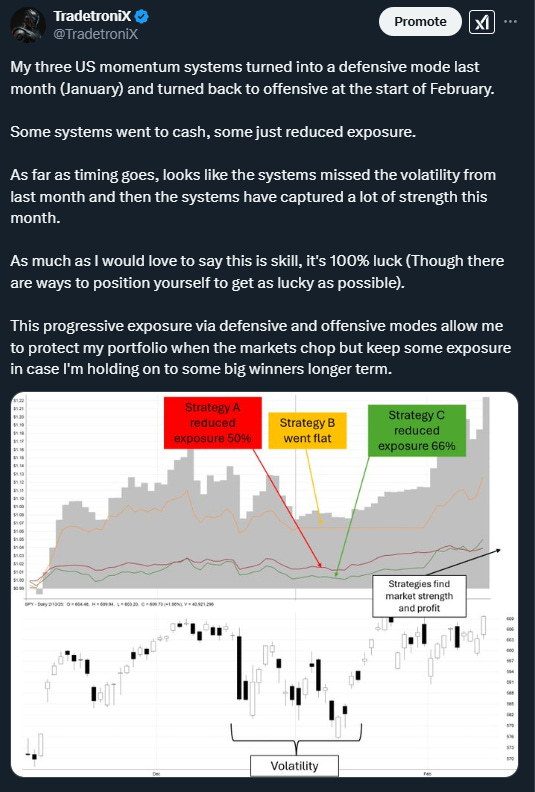

I was able to avoid some of the market choppiness at the end of January and beginning of February. This is because my US momentum systems went into defensive mode and sold their weakest positions. I ended up holding only the strongest stocks during that period, which defiantly helped out the overall portfolio. I am now fully allocated to US momentum again for February. See my tweet about this for more details.

I recently got back from a week-long ski trip in Park City, Utah. I took my trading laptop with me so I could run all my systems and place my orders every morning. I was getting up between 5:30am and 6am every day to do this because of the time change. Even when you are on vacation, the grind never stops; the trading must happen. I also ended up getting the flu halfway through the trip. I felt like I was hit by a bus, so getting up that early was mentally difficult to say the least. I'm glad I did it though, because the portfolio performed fairly well while I was on the ski trip (the large ramp-up in portfolio equity during February was when I was on the ski trip). If I had slacked off and not done my trading, I would have missed out on some of these gains. You never know when the portfolio is going to make money; that is why you always have to be trading, no excuses. Here's a picture of me snowboarding, before I got the flu.

It was a beautiful place to spend the week. While on this ski trip, I picked up on some interesting human psychology traits during conversation (traits most of us already know about, but always interesting to see enforced). There were 7 of us who went on the trip, and the topic of stocks came up a couple of times (not by me). People were sharing their big winners, how they bought XYZ stock early and made good money on it recently, how they are going to buy ABC stock tomorrow when the market opens because they had a "good feeling" about it. I never said a word about my trading or the stocks I own (none of these guys actually know what I do). Instead, I just played dumb and listened to the conversation as a form of entertainment. I loved hearing all the biases and misunderstandings the average investor makes. My favorite quote I heard was "Just buy bankrupt airline stocks, the government bails them out every time and you always make money". Sure, that may work, until the government doesn’t bail them out. To me, that's the equivalent of saying "Just walk out in front of a train, they stop every time". Anyway, I digress.

Recent Losers:

Listening to these conversations just cements the notion that everyone is a genius in a bull market. It also cements the sentiment that everyone seems like a genius when all they share are their winners, so don’t be fooled by anyone sharing only winning trades. So with that said, here are my recent losers:

Recent Winners:

And of course here are some winners too, everyone loves some good winners.

Favorite Trade Recently:

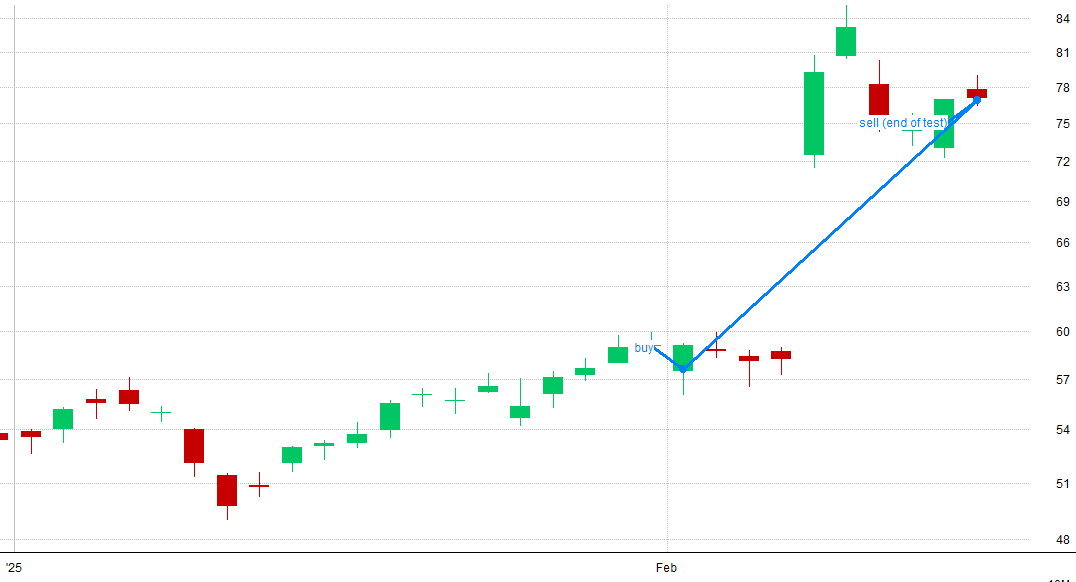

Here is my favorite trade of the month. I got into this position at the beginning of February; a couple days later, the stock jumped ~30%. Then at the peak, my short system kicked in and shorted the high of the day and covered the next day after an ~8% pullback. I am now long again and the stock is consolidating and looks like it wants to go higher. I wish I could say this was skill, but it wasn't; 110% luck. You trade enough, and eventually, this will happen. Still cool to see though.

That’s all I had for this portfolio update, will see you in the next article. Until then, happy trading!

Do you have ideas/suggestions for future articles? Let me know what you want to read about by clicking the button below and submitting your suggestions. Your suggestions are greatly appreciated as they help tailor this newsletter to what you want to read about.

I’ve researched cross-sectional momentum and dual momentum strategies in the past, but never launched any because I couldn’t stomach the large drawdowns they suffered. Any hints as to what you use to switch into defensive mode?

Kudos!!!