You're Stealing From Your Future Self

How Procrastinating Your Systematic Trading or Investing Journey is Stealing Time and Money From Your Future Self

Welcome to the “Systematic Trading with TradeQuantiX” newsletter, your go-to resource for all things systematic trading. This publication will equip you with a complete toolkit to support your systematic trading journey, sent straight to your inbox. Remember, it’s more than just another newsletter; it’s everything you need to be a successful systematic trader.

Introduction:

As a systematic trader or even an investor, the most dangerous thing you can do is procrastinate. I know you have tasks you’ve been putting off, tasks you keep kicking down the road: “I’ll do it next week,” you tell yourself. Next week comes, and then it’s the week after that. I know because I’ve done the same exact thing; it’s human nature.

Usually, the tasks we procrastinate on are the ones we don’t want to do, but often, the tasks we procrastinate on are the highest-value-add tasks. We’re all busy, we all get tired, we all don’t want to do it, but we have to.

To be the most successful version of ourselves, sometimes we just have to dig in, embrace the struggle for a little bit, work hard, and after a while, we look back and barely recognize ourselves with the progress we’ve made.

It doesn’t matter if you’re a systematic trader or a long-term investor; the difference between working hard now and procrastinating can add up to millions of dollars compounded over a lifetime. The earlier you start, the more wealth you can compound over time, allowing you to achieve financial freedom and your dreams sooner.

If you’ve been meaning to expand your knowledge in systematic trading or become a savvy investor, the time to start is now. Not tomorrow, not next week, not six months from now. Now. The sooner you start, the sooner you’ll be free.

The Power Of Compounding Early:

I can’t stand it—watching people work hard their whole lives, trying to save as much as they can so they can retire someday. Their savings melt away to inflation, the world gets more expensive, and the value of their savings diminishes over time. This is why beginning your investing or systematic trading journey now is so important.

If you’re in your 20s or 30s, the difference between retiring in your 40s or 50s and the usual retirement age of 65 is the difference between learning investing/systematic trading now, as opposed to starting 2 to 5 years from now. Yes, just 2 to 5 years of slacking can add tens of years to your retirement timeline and the time it takes to become financially free.

Let’s look at this concept from the perspective of a systematic trader, though it directly applies to passive and active investors as well. Systematic trading can be a daunting task. If you’ve never done anything like this before, it can be frustrating, and just like learning any other skill, it could take a lot of time to master.

I’ve worked with many systematic traders, and a lot of them become discouraged or frustrated with how long it takes to complete certain tasks when they’re first starting. This is because they don’t have the practice yet, but over time, they become more efficient.

This is why I say you need to start now. You need to put in the work now to become good at systematic trading (or investing in general). You can have a fully operational and established, diversified, systematic trading portfolio up and running by the end of 2025 if you start now.

Let’s run a simple simulation:

Imagine, you’re 25 years old.

You develop a systematic trading portfolio.

You invest $50,000 into that portfolio.

That portfolio compounds at a rate of 20% a year.

Yes, 20% a year is possible with systematic trading.

You save hard and add $500 a month to the portfolio.

You trade this portfolio for 15 years.

At the end of the 15 years, that portfolio would’ve grown to 1.24 million dollars:

The best part: now you’re 40 years old and have the freedom to do whatever the heck you want with your life.

Maybe $1.24 million is enough to retire; maybe it’s not. Either way, with $1.24 million in the bank, the freedom you’ll have will be tremendous.

Here’s how powerful compounding is: let’s say $1.24 million isn’t enough to retire. So, let’s wait just 5 more years…

Now, we have a $3.13 million dollar portfolio. Wow! And with more aggressive saving strategies, say saving $1,000 or $2,000 a month instead of $500 a month, this final portfolio value becomes enormous.

If, instead, you procrastinated for just two to five years before diving into your systematic trading journey, that same portfolio would be worth hundreds of thousands of dollars to even millions of dollars less in future value.

This is the time value of money and opportunity cost. Procrastinate and waste time now, and you steal from your future self.

So, do your future self a favor and start now. It might suck for a little bit. It might be frustrating, but your future self will thank you for it, and you’ll be proud that you did it. There’s a famous saying that I love: the best time to start was 10 years ago; the second-best time to start is now.

By starting now, you gain financial freedom and security, and the ability to do whatever the heck you want with your life significantly sooner than if you start just a few years from now.

Imagine this trade-off:

Working really hard for the next few years to build up your systematic trading or investment portfolio, spending some early mornings on weekends or late nights on weekdays developing your portfolio and skills.

In return, that trade-off may mean you get to retire 10 to 20 years earlier, retiring in your 40s rather than your 60s.

To me, that decision is easy:

Embrace the suck and the time commitment now in return for a better and more free future.

Not only does your money compound, but your time investment compounds as well.

A few years of hard work now will compound into 10 to 20 years of freedom in the future.

By starting earlier, not only will you be able to build wealth sooner, but you’ll also improve your skill sets, discipline, and confidence as a systematic trader or investor. As I mentioned, just like with anything else, it takes a lot of time and effort to master the craft of systematic trading or investing.

The longer you procrastinate, the longer it will take for you to master. The longer it takes for you to master, the longer until you are financially free.

I know your life might be busy, but even finding 30 minutes here and there throughout the week to focus on systematic trading or investing can really add up over time.

I’ve heard it a million times: people say something like,

“Oh, I’m super busy with life right now. I’ll start my learning journey next year when things slow down.”

This line of thought is reasonable to most, but I’ll tell you why it doesn’t make sense to me. Even just finding a few minutes here and there over the course of the next year to focus on building your craft will compound over time. Then, by the time you actually have a lot of spare time to dedicate to becoming a systematic trader or investor, you’ll be hitting the ground running.

Instead of telling yourself you are busy, find 10 to 30 minutes a day and start your journey. Then, by the time your life becomes less busy, you’ve already built the baseline foundation of knowledge, and now you can use your extra time to really accelerate your progress. Remember, it will never be the perfect time to start; that’s why you just need to start now.

We Are All Busy, But You Can Make Time:

Look, I get it. We are all busy. We all have commitments and things that take up more time than we would wish. But, I promise you there’s time in your week to focus on developing your systematic trading or investing portfolio. I’m not the busiest guy in the world, but I’m also not the most free guy in the world either.

Currently, my weekly schedule looks like this:

6am: I get up and eat breakfast, take out the dog, run my trading systems, and get ready for work.

7am: I leave home and begin my drive to work.

4:30pm to 5pm: I get home from work.

5pm: I take my dog on a long walk until around

6pm: I eat dinner and then head to the gym,

7:45pm: I get home from the gym and take a shower

8pm: I finally have free time to do what I would like. This is when I focus on my trading. I’ll spend one to two hours developing a new system or running maintenance on my systematic trading portfolio.

10pm: I get ready for bed.

And on the weekends, all I do is work on my systematic trading business.

My schedule is busy. I understand it’s not the busiest schedule in the world. I don’t have kids, I don’t have elderly parents to take care of, and generally, my workdays are no more than 8-10 hours, but the point should still land. I still find the time to do it, even though I don’t want to. By 8 p.m., I’m tired and mentally drained, but I’ve been building up my systematic trading portfolio for years now, and at this point, it’s just a habit.

I’m not trying to flex or show off how great I am. I am not better than you or anyone else. I just dream of financial freedom, and I’m chasing that dream. I want to retire early, maybe in my late 30s to 40s. The thought of being able to do whatever the heck I want with my time in just 10 to 15 years from now vastly outweighs the suck and busy lifestyle that I put myself through now.

How To Be More Time Efficient So You Can Focus On Systematic Trading:

There are probably a few things in your life that you could cut down on or optimize to find an extra 30 minutes a day.

For me, I spent some time optimizing a few things to get back some time every day. This allowed me to get just a little bit more done every day, which compounds to hundreds of hours more progress every year.

One thing I optimized was reworking my workout program plan so that it was just as effective but 30 minutes quicker. That’s 30 more minutes I can spend on my systematic trading every day.

I also found that I am relatively productive early in the mornings. I don’t classify myself as a morning person, but it’s much easier to make progress while the world is still sleeping. On weekends, I started waking up early, between 5 a.m. and 6 a.m., to work on my systematic trading business.

It’s 7:36 a.m. right now on a Sunday. It’s raining outside. I wrote this article yesterday afternoon, and now I’m editing it. I’m drinking my first cup of coffee from my Wonder Woman mug, listening to some Rush and Metallica while my dog is sleeping next to me.

Think about this:

If you spend one hour a day watching Netflix or scrolling social media and are able to cut that down to just 30 minutes a day—not remove it, just reduce the time spent—that’s an extra 182.5 hours of productive time over a year that you can use to work on your systematic trading or investing journey.

Honestly, this is something I could work on as well. I probably spend more time than I should on social media. I bet I could spend half the amount of time on social media, still get my dopamine hit, and gain back hundreds of hours over the course of a year in productive time. It’s honestly insane to think about how much time TV and social media suck from your life.

I have come across some optimization tips I found helpful for gaining back hours of time over the course of a week. These aren’t necessarily hard things to do, and they may only save 15 to 20 minutes here and there, but if you stack a bunch of these together, you can gain back hundreds of hours over the course of the year.

Tip #1: Multitask With Mundane Tasks

A big part of being a systematic trader is education and idea generation. For me, a lot of my education and ideation comes from reading articles online or listening to podcasts. I tend to double up my education tasks with other things like while walking the dog, at the gym, or on my drive to work.

Multitasking my education and idea generation while doing other mindless, mundane tasks has added about 1 to 2 hours of efficiency to my life every single day. That’s 365 to 730 hours of extra learning in the realm of systematic trading every single year.

I love Substack for learning and coming up with trading system ideas. I use Substack’s read-aloud feature to read me articles I’m interested in, rather than sitting in front of my computer or scrolling my phone to read them myself. This allows me to multitask while “reading.”

I’ll also leverage free online tools, such as Microsoft Word, and utilize the read-aloud feature for other articles found online. I’ll copy and paste the article contents into the Word doc and have it read the contents to me. This makes everything a podcast and gives me the ability to multitask while I learn.

I’ll be completely honest: I’m multitasking to write this article right now! I consider writing articles on Substack as part of my systematic trading business, so it’s something I need to work on every single week, and it can be hard to find that time.

As I write this, I’m watching my dog run around in a muddy puddle of water, wearing himself out chasing birds, while I talk into my headphones, “writing” this article using text-to-speech.

I’m wearing my dog out and working on my systematic trading business at the same time. If I don’t wear my dog out, he will be an absolute menace for the rest of the night, and I won’t get anything done anyway.

All of these multitasking tips are leverageable for saving time outside of systematic trading as well. Combine mundane, low-effort, low-mental-capacity tasks together to save time.

If you have to make a few phone calls, make those calls while you’re walking the dog, unloading the dishwasher, or driving to work. You just saved 15 minutes that you can now spend on systematic trading later.

Everyone on the internet says multitasking actually makes you slower and less efficient. That’s true if you multitask with multiple high-mental-capacity activities. Writing emails while also listening to a trading podcast is going to make you zone out from the podcast. Those are two high-mental-capacity tasks. That’s why I focus on multitasking with low-mental-capacity activities.

Combining low-mental-capacity, mundane tasks that I have to do every day has been one of the highest-expectancy things I’ve done in terms of gaining back time to work on my systematic trading business.

Tip #2: Optimize For How You Feel

Something to consider: not every day are we going to be feeling mentally at our best. Some days, we’ll be tired, exhausted, and drained. On days like these, just focus on things that are easy to do, like listening to podcasts or articles.

Then, we’re still making progress on our learning without having to utilize a bunch of mental capacity developing trading systems, expanding our trading portfolios, or doing market research.

On days when we feel great, or maybe we have a little bit of extra time, and we got plenty of sleep the night before—focus on the really mentally engaging tasks. There’s no sense in grudging through mentally demanding tasks when our mental capacity isn’t there that day. We’ll probably be wasting our time due to being at a low efficiency level anyway..

Tip #3: Focus On Planning

Another powerful technique I’ve started doing this year is taking some time to focus on planning. I’ll plan out the high-level tasks I need to get done to reach my goals. Then, I’ll break down those tasks into smaller and smaller subtasks.

Sometimes, planning feels like a waste of time.

We think to ourselves:

“Instead of spending all this time planning, I could’ve already gotten the first task done! Is planning really all that great? I thought it was just a fad?”

I used to feel the same way (sometimes I still do!). But I found that taking a little bit of extra time to plan out everything that needs to get done over the next day to a few weeks from now has really accelerated my progress.

I know this is unreadable, but there was no other way to get the screenshot. Below is my plan I created at the start of this year, which I use to prioritize what tasks I focus on now. It’s not pretty, but it works!

Every time I sit down at my desk, I know exactly what I need to do to improve.

I used to sit down at my desk and fumble around for 20 minutes just trying to figure out something productive to work on. Now that I have a structured plan, it takes me about 30 seconds to look at my plan, see exactly what I need to work on, and then I immediately get started on the high-value-add tasks that I need to get done.

Tip #4: Outsource Low Value Add Activities

Another consideration might be to outsource low-value-add activities to someone else. If every week you have to mow the lawn or clean the house, it may make sense to pay someone else to do those things for you. I’m not trying to say these jobs aren’t important—not at all; I used to mow lawns for a living. All I’m saying is they are taking time away from your systematic trading or investing journey.

Sure, having someone else mow your lawn may cost you $50 a week, or having a cleaning person clean the house may cost $200 a week. If finances are tight, that might be hard to swing.

But think about it this way:

If you took the time you would otherwise be using to do low-value-add tasks and instead used that time to focus on high-value-add tasks for your systematic trading or investing, you could have your systematic trading or investing portfolio developed and ready to go this year.

Going back to what we discussed earlier about the time value of money:

If you spent $2,000 a year outsourcing a low-value-add task, and in return, you created a trading system that generated $20,000 a year in returns, and that $20,000 compounded to larger and larger sums of money every year, I would say that’s a pretty high-expectancy trade.

You would gain back all of the investment you put into outsourcing your low-value-add tasks in an extremely short period of time.

I’m not saying to shell out a lot of money to outsource some tasks if finances are tight. But it’s something to consider. Do the napkin math yourself and see how feasible this tip is for you.

Tip #5: Find A Trading Buddy

Find a trading buddy or a community of like-minded traders and work together. Systematic trading for retail doesn’t have to be a competition like many people think it is.

I would much rather work with a friend to develop a few trading systems twice as fast, and then share the results, than have to spend twice as much time to get to the same place myself.

I have a few trading systems that I developed with some friends I met online. We all trade some of the same systems, and to be honest, I wouldn’t have been able to develop those systems without their help. Not only did it save me time by working with them, but I ended up twice as far as I would have if I was only working on my own. I also ended up with a much better system than I could’ve created myself.

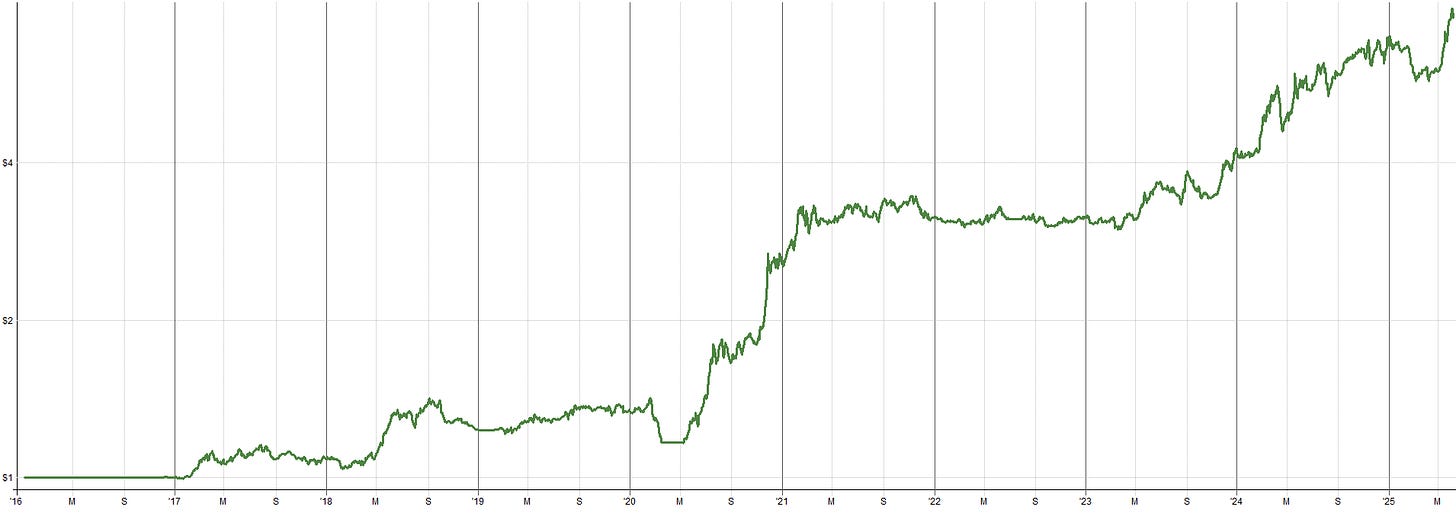

By the way, this is the trading system we created; I can’t give many details on it, but it has been a fantastic diversifier to my portfolio, and the performance recently has been great:

Tip #6: Don’t Waste Small Pockets Of Downtime

Short periods of downtime tend to pop up sometimes; don’t let these go unused. Maybe it’s just 5 to 15 minutes while you wait for your haircut. Use that time to do quick and simple tasks that end up saving hours every week.

Here’s an example I do a lot. Going back to my trading education, I have to figure out what I’m going to focus on next in terms of my education. So, while I’m at work, I’ll use part of my 10 to 15 minute lunch break to find a podcast or a set of articles to listen to later in the day. Otherwise, I would be adding that 10 to 15 minutes to later in the day, taking away from my productive time.

Another thing I do is run my trading systems while I make breakfast in the morning. Running my trading systems every day takes around 5 to 10 minutes, but it’s a relatively low-effort task, so I can pair it up and multitask while my eggs cook on the stove.

Don’t think that just because you have a spare few minutes that it can’t be used. A few minutes here and there adds up over time!

How Small Time Commitments Can Compound:

Let’s put it all together. Optimizing your schedule so you can find 30 minutes a day to focus on systematic trading activities can compound into massive progress over a relatively short period of time.

Finding 30 minutes a day to focus on systematic trading is 182.5 hours of improvement every year.

Consider this:

Say it takes you around 5 hours to develop and test a trading strategy.

By working for 30 minutes a day, you can test out ~37 new ideas a year.

Say only 25% of your ideas are any good, and 75% if your ideas fail.

By the end of the year, you’ll have around 9 to 10 quality trading systems that you can use to build a systematic trading portfolio.

A 10-system trading portfolio can be a killer portfolio. With 10 systems, it’s more than possible to have a compound annual return of 15% to 30% a year, with lower drawdown than the general market on average.

That result is just 30 minutes a day away. In the beginning, you might be a little bit slower and not as efficient, but by starting now, you can start to grow your systematic trading or investing muscles, become more efficient, and get better at the skills over time.

I’ll be honest:

The first trading system I ever tried to make, a little over 5 years ago, took me around 40 hours to code.

That’s not because it was some intricate, sophisticated system; I just didn’t even know how to code at the time.

But by continuously practicing and finding 30 minutes a day, I’ve been able to reduce the amount of time it takes to code up a trading system.

The time it takes to code new system ideas has gone from 40 hours to around 20 minutes, or less.

This allows me to test more ideas than I ever could have imagined, allowing me to grow my portfolio and work toward my goals of financial freedom.

If you’re getting eager to start your systematic trading journey now, you can check out this other article; where I lay out exactly what I would do if I was starting over again:

A Necessary Read For Those Who Want To Begin Trading Systematically

So you want to become a systematic trader? That’s great! It will be a journey full of lots of work, but one day it will all be worth it. When I first started systematic trading, I had no idea what I was doing and figured most things out the hard way (the hard way being losing money or wasting time). I wish I transitioned to live trading sooner, I wish I didn’t waste so much time making perfect backtests, I wish I used better risk management etc. but such is life.

Conclusion:

If you decide to procrastinate and start your systematic trading or investment journey two years from now, it’s going to be at least another year from there before you’re actually at the point where you’re making good progress and really building up your portfolio.

Two years from now is really more like three years from now once you consider the learning curve and the time it takes to get up and running. By continuing to procrastinate starting the systematic trading or investing journey, you’re robbing hundreds of thousands or even millions of dollars in potential wealth from your future self.

So, look at this opportunity like a trade. Trade some free time now, embrace some suck now, get down and dirty with the learning now, do this for a few years. Let this effort then compound for 10 to 15 years. After that, your few years of hard work will result in potentially tens of years of freedom and hundreds of thousands of dollars more in wealth.

That’s probably the best trade you or I will ever make.

If you decide that you want to take the leap and begin your systematic trading journey now, setting up your future self for success, consider signing up for the Systematic Trader School.

📈 This will consist of 10, 1-on-1 consulting sessions with me! By the end of the 10 consulting sessions, you’ll have a robust portfolio of 3–5 designed, developed, and implemented systematic trading strategies.

🥇 These aren’t theoretical trading strategies—you’ll develop real, tradable strategies for use with your trading account.

🚀 I’ll guide you step-by-step, from planning your portfolio and developing your own trading strategies, to conducting robustness testing and implementing the portfolio live.

📚 To learn more, check out the Systematic Trader School page. Also, you can book a free 30 minute consultation. During the call, I’ll explain exactly how it works and the transformation you can expect:

👉[Click here to learn more about the Systematic Trader School!]👈

👉[Click here to book a free 30 minute consultation!]👈

Do you have ideas/suggestions for future articles? Let me know what you want to read about by clicking the button below and submitting your suggestions. Your suggestions are greatly appreciated as they help tailor this newsletter to what you want to read about.

Really enjoyed the post. I’ve been struggling a lot with point 5. I know the kind of rewards that come from collaborating on projects (which are necessary if you’re serious), but it’s a bit like dating trying to find someone who’s as intense or motivated as you are. How did you find others?

I created tradingpod.info about a month ago out of frustration over a weekend. It still needs some redefining, but it’s good for now.

That’s incredible to think about!