A Necessary Read For Those Who Want To Begin Trading Systematically

Things I Wish Someone Told Me When I First Started My Systematic Trading Journey

Introduction:

So you want to become a systematic trader? That’s great! It will be a journey full of lots of work, but one day it will all be worth it. When I first started systematic trading, I had no idea what I was doing and figured most things out the hard way (the hard way being losing money or wasting time). I wish I transitioned to live trading sooner, I wish I didn’t waste so much time making perfect backtests, I wish I used better risk management etc. but such is life. This article is going to walk through a lot of the things I wish someone told me when I first started systematic trading. Hopefully, you can pick up on a few lessons and not have to learn them the hard way, like me.

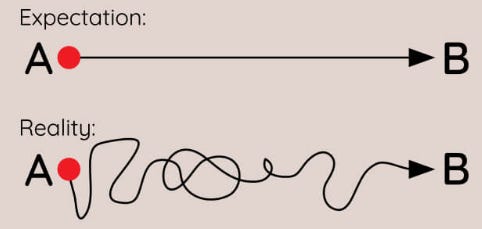

When I first started systematic trading, I had no path, I wondered aimlessly and made very slow progress. I overlooked a lot of important concepts and not only did I not know a lot of things, but I didn’t even know what I didn’t know; but eventually I learned, and so will you. Like most new skills you learn, when you first start you expect the learning path to look like a straight line. In reality, the learning path looks like a set of wired headphones that have been shoved it your pocket all afternoon.

My goal is to try and make that learning path as straight as possible for you. You need to tune out all the noise and distractions and focus on the end goal. That guy on YouTube with a 1,000,000% return backtest is full of crap. You don’t want to get distracted by this stuff, you need an end goal and a vision. You need to take the quickest route to get to your goal in order to become successful with systematic trading as soon as possible. This means you need to get to live trading as soon as possible (assuming live trading is your goal, which if it’s not I’m not sure why you are here!). In my opinion, the most important thing for beginner systematic traders to do is to begin trading live as soon as possible, even if it’s just with small amounts of capital. That doesn’t mean you skip steps to try an go live tomorrow, instead it means you should be avoiding rabbit holes and methods that will take you years to implement. The most valuable experience is live trading experience. You will learn a tremendous amount of information by observing how your systems behave in the markets real time. This experience will help you create better trading systems and allow you to continually improve over time. If you spend too long in the initial system development and learning phase, you will be prolonging the real learning which comes from actual live trading.

I’ve known people who have spent literally years in the system development phase. I have even met people who never actually went live with any of their strategies because they thought the strategies weren’t good enough. The funny thing is I have trading strategies similar to what they created. I trade those strategies live and have mode money with those strategies. The pursuit of perfection held these people back from making money trading. It’s very easy to get distracted by trying to be perfect or chasing some new idea you saw a trading guru talking about online. There is so much noise in the trading space it is easy to get lost. So let’s clear up your path so you can start your journey down the road to being a systematic trader ASAP.

Index of Topics to Discuss:

What trading style/market to start with

What strategy types to start with

Where to start when it comes to backtesting

Getting quality timeseries data

Searching for the holy grail

Don’t compare yourself to others

Be prepared for some psychologically difficult times

Treat systematic trading like a business

What Trading Style/Market To Start With:

When looking online, you’ll see a million different ways people trade. Discretionary trading, systematic trading, trading intraday, trading with daily bars, swing trading, high frequency trading, and many others. It’s very easy to get confused about what method you should pursue. Since this is a systematic trading newsletter, I will focus there, but discretionary or a mix of discretion and systematic trading are also a fine choices if they suit your personality and lifestyle.

Even within systematic trading specifically, there are a bunch of different options. Do you trade on 1 minute bars, 1 hour bars, daily bars, weekly bars? Do you trade stock shares, options, futures, forex, crypto? So many options and only a limited amount of time, so where do you even start? Well, before you pick a niche consider your lifestyle. If you have a day job it may be difficult to do any sort of intraday trading. You would need to develop a very detailed piece of software to manage intraday trades with very robust error handling to ensure your code doesn’t go haywire and blow up your account while you are at work. Not a good place for a beginner to start. Another thing to consider, do you understand what you plan to trade? If you have been a passive investor buying stock shares your whole life and have never touched options or futures etc. does it really make sense to start with a leveraged instrument you likely don’t understand? If you understand trading stock shares and you have a day job then you should probably use a trading style that involves stock shares on a timeframe that doesn’t require you to be sitting in front of your computer all day, for example.

You should start with the easiest method for your lifestyle. Trading is hard enough as it is, there is no need to make it harder by trading a style that doesn’t fit your lifestyle. I know because I did it, I traded an intraday system while having a day job. The stress of having to carry around my laptop and constantly check if my trading system crashed while at work was obnoxious and hurt my performance at work. I would be sneaking out my personal computer to reboot my trading system and trying not to get caught by any coworkers. If I was in a meeting, forget about it, the system would have to wait to be rebooted until the meeting was over, not a great situation. As soon as I switched to a daily trading approach (no intraday trades) my stress dropped immediately. I talk about this example because most people getting into systematic trading do have day jobs, but if you don’t then maybe you can get away with intraday trading, if that’s something you want to do that’s absolutely okay, as long as it fits your lifestyle.

You also want to consider what market to trade from the perspective of who else is playing in that market. A very mature market with big players from hedge fund will be more difficult to trade in because you have someone with more experience than you on the other side of your trade. Just like how you don’t want to go to the best poker table when you are still learning, you don’t want to trade the in most competitive market when you are a beginner. For example, high frequency trading is dominated by big hedge funds, not a great place for beginner retail traders to play. Instead, focus on markets with smaller, less intelligent players. Examples of markets like this would be crypto, smaller stock markets (non-US markets), or lower volume stocks on large stock markets where the big players can’t participate but you can.

So long story short, consider your situation. It probably doesn’t make sense for you to trade systematically intraday if you have a day job. It probably doesn’t make sense to start systematic trading with an instrument you don’t understand or in a competitive market. Start with the lowest barrier to entry, for me that would have been trading stock shares or crypto on a daily timeframe (or higher). You can always get more complex and trade other instruments or on lower timeframes as you get more experienced. The most important thing is that you start trading and don’t waste time in development mode trying to make some complex high frequency trading bot while also working a day job. Start with the lowest barrier to entry and expand/improve from there.

What Trading Strategy Types to Start With:

Okay so you have considered what systematic trading style/market potentially works best for you. Now, what strategy types should you explore in order to begin trading? Well, there are many strategy types you could employ such as a momentum, trend following, mean reversion, arbitrage, pairs trade, etc. How do you choose which one to start with? Personally, I would start with a trend following or momentum approach.

Let me define what I mean by trend following and momentum. Trend following is buying a security that is trending up or down. So if a security has had choppy performance for awhile and all the sudden has started to trend either up or down, a trend following system would capture that trend and ride it until the trend is over. Momentum is similar, but I tend to think of momentum as cross sectional. Basically, you compare the recent performance of all securities and buy only the securities that are performing the best relative to other securities in the same asset class. So if a momentum system was trading stocks, it would by the top x number of stocks that are outperforming the entire market. You could also do the opposite and short the worst performing stocks. This effect also exists in other securities like crypto, where coins like to skyrocket, so if you can catch some of these trending moves you can pocket some profits.

There are many reasons why I always recommend trend following and momentum type strategies for beginning systematic traders. These strategy types do not try to fight the markets, they attempt to go with the direction of the markets. Some traders try to pick tops and bottoms, which is difficult to do. It is much easier to go with the prevailing market trend, like finding a wave in the ocean and riding it into shore, as opposed to trying to fight the waves to swim deeper into sea.

Another reason is because trend following and momentum strategies are more robust to mistakes. Whether you are a beginner or a seasoned systematic trader, mistakes still happen, that’s life, they still happen to me too. Over time the mistakes happen less and less, but as a beginner you have to expect there to be mistakes such as missing a trade entry/exit, getting into or out of a trade late, accidently typing the wrong position size etc. So many little things to mess up. Trend following and momentum strategies tend to be more robust to mistakes like these because they tend to have a larger expectancy per trade (expectancy is the average amount of money a trade is expected to make). So, even though these mistakes will potentially cost you money, there is more margin in your strategy’s expectancy to cover the cost of these mistakes. Some systematic traders trade systems with very low expectancy, so any mistakes essentially make the system unprofitable. One day, when you get your process cleaned up and the mistakes slow down, you can gravitate to adding some lower expectancy systems to your portfolio, but as a beginner I would say there is no need to force yourself to trade in a manner that requires your execution to be near perfect.

Where To Start When It Comes To Backtesting:

So, we have discussed what style/market to trade as well as what trading strategy type to start with. Now that you have considered what will work best for you, it’s time to start developing a trading system. But, where do you even start? There are so many backtesting tools available, how do you know which ones to use? You could use one of the many off the shelf softwares or even develop your own tool(s) from scratch. Many times beginners think it is required to build their own backtesting platforms from scratch. Benginers may think this because they see people online with their own backtesting platforms or because they are unaware of what off the shelf backtesting softwares already exist.

I want to make it clear, it is absolutely not necessary to develop a backtesting software from scratch. Sure, one day in the future this may be an avenue you want to pursue, but developing your own backtesting software as a beginner is not an easy task. There are so many assumptions in a backtesting software that you will likely overlook because you haven’t had the real market experiences yet. So, I would recommend leveraging a quality backtesting software off the shelf to start. If you are looking to trade daily/weekly/monthly bars with end of day data (what I do), software like RealTest or Amibroker will do the trick. If you are looking to backtest with intraday data then you could look into software like Tradestation, Multicharts, TradingView, or Amibroker can also do intraday backtesting. I personally have only used RealTest, Amibroker, and Tradestation so I can speak to those pieces of software, and all three are fine places to start and are relatively cheap for the services they provide.

If you insist in developing your own backtesting software solution, at least don’t start from scratch. There are packages for python that are helpful for backtesting such as Backtrader, Zipline, TALib, PyAlgoTrade, VectorBT etc. I personally do not have a lot of experience here so I would encourage you to look into these more yourself because I cannot provide a lot of insights. The only insights I can provide is when I first started with systematic trading I tried to make my own python backtester and it was tremendously difficult. I also wasted a lot of time on the backtester itself and no time actually developing trading strategies. I only started making real progress once I switched over to an off the shelf software. To be fair, I am not a software developer, I am just an okay python coder at this point, but maybe you are a lot more comfortable with a task like this. Just know that developing your own software will set you back from actually starting to trade. You will overlook or incorrectly model something in the backtesters assumptions and you will be spending more time building the backtester than actually creating a trading system. This wastes precious time in the markets where you could be learning from live trading experiences, or even making money.

Getting Quality Timeseries Data:

This one is important. Imagine you put all this work in to develop your first trading system, just to find out your data quality is poor and the system is not actually profitable. Believe it or not, this can definitely happen. Data quality is one of the most, if not the most, important aspects of systematic trading. You can’t accurately develop and test a systematic trading strategy if your data sucks. The data needs to be reflective of what the markets actually did real time and not have any gaps, missing, or incorrect data.

I’ve seen multiple traders put a lot of time and effort to their systematic trading, but try to cut corners on quality data because it can be expensive. It’s similar to building a house and trying to save money by not pouring a foundation, that’s crazy! Your data is the foundation of every trading system you will build. Use crappy data and all of your trading systems could fall apart during live trading. So, the point here is don’t skimp out on quality data even though sometimes it is expensive. If you are taking trading seriously the expense of a quality data source should not be a deterrent.

For end of day trading using daily bars and higher, I use Norgate Data. Norgate has data for the US, ASX, and TSX stock markets. They also provide daily data for futures and Forex. Norgate is one of the highest quality data sources I have found. If you want to trade other stock markets, then Metastock is another option for daily stock data for many other markets around the globe. Metastock data quality is not as good as Norgate in my experience, but it is the best option I have found for stock markets other than the US, ASX, and TSX (if you have found better sources for other global stock markets, please let me know!).

For intraday stock data you could look at data sources like Polygon.io, Alpaca, or sometimes your stock broker will provide intraday data for a fee. Just be sure to look through the data with a fine tooth comb to ensure the data matches what happened real time and there are no large data gaps. For stock and crypto data, a lot of times big name exchanges will let you pull historical data from their servers. Just note that the data they give is only for currently listed stocks and coins and usually does not include delisted stocks and coins, so there is a survivorship bias built into the data. I do not trade crypto (yet) so I am unware of quality data sources to be completely honest, but a quick internet search gave a bunch of options. Just be sure not to get the cheapest one because its the cheapest, do some research and get the data that’s the most accurate and complete for your needs.

There are many data sources out there for the market and timeframe you are looking to trade. I have not necessarily used every data source I listed above, so some may be junk, though I have heard good things about the sources I did list. You will have to be sure to do your due diligence in researching where to find quality data and be sure to look it over closely to make sure it’s a complete and accurate dataset. Do not let cost be the decider in what data you buy, focus on data quality.

Searching For The Holy Grail:

It doesn’t exist. If you are unaware of what the holy grail is, it’s the magical trading system that makes you rich fast with minimal risk. Many systematic traders have been on the search for the holy grail for years, and they all have come up short. Yes, there are good trading systems out there you can develop, but a system that is perfect in every way is a myth. Do not waste your time trying to develop the perfect trading system, or else you will be stuck in the system development phase forever.

You should start with just an okay system, and be okay with that. None of my systems are amazing, they are all just okay. The real magic occurs when you trade a portfolio of many uncorrelated okay systems. This is the closest thing to the holy grail. So, your mindset when developing a trading system should be this system will be just one system of a whole portfolio of many systems; where each system contributes in its own way. None of the systems are perfect, but the combination of the many uncorrelated systems will look pretty darn good.

So the message here is don’t get bogged down because the performance of your system isn’t as good as you would like. Just make sure the system is robust and was developed properly with quality data and start trading it. Then, set your sights on starting the development of your next trading system. After a few years you will have many trading systems and with each uncorrelated system you add to your portfolio, your performance will get incrementally better and better.

Don’t Compare Yourself To Others:

I’ve been guilty of this one. Every time I open X (formerly Twitter) I see traders posting their PnL and it makes me think I am not a good trader. I have to remind myself this isn’t a competition. Everyone trades at their own pace and there will always be people better than me. Focus on your own portfolio and constantly try to improve it. After a few years you may look back at all the work you have done and realize your systematic trading portfolio is just as good as the traders you used to compare yourself to.

One mind shift that may be helpful, use the traders who are better than you as people to learn from. Rather than be jealous or feel inadequate compared to them, ask them questions and see what little nuggets of info they can provide to make you a better systematic trader. You may be surprised with how generous some of these traders are with sharing helpful information. Just be careful, because some of these “amazing traders” are fake gurus, posting fake PnL images and are just trying to sell you a trading course that doesn’t work. There is a lot of noise out there, so be careful who you see as a great systematic trader, but if you do find someone who seems credible, use them as a resource to learn from as much as you can.

Be Prepared For Psychologically Difficult Times:

This one is easy to overlook. When I started trading I was not prepared for the massive drawdowns my trading systems endured. I still remember the feeling, after going into a $20,000 drawdown it was like there was an empty pit in my stomach. It was so difficult I had to stop trading for around 6 months. These things happen, it’s part of the game. There is no real way to prepare yourself for the feeling, so just be aware that you will have to experience drawdowns and the psychological difficulty associated with them.

On a related note, don’t overlook the risk in your trading systems. The whole reason why I had such a traumatic experience is because I was so focused on the reward that I completely ignored the risk. Risk should always be addressed first, only after risk is addressed should you focus on reward. If I had done this I would not have had such a tough time. So, if you want to have a smoother ride psychologically (and with your PnL) when it comes to trading, remember to address risk first!

With that said, a drawdown of some amount is inevitable, and it’s never fun. Be sure to understand what kind of drawdown your trading system could endure so you are ready for it psychologically. Otherwise, when the inevitable drawdown occurs, you may freak out and pull the plug like me. The hardest part of trading is sitting on your hands and just waiting for your trading system to pull you out of drawdown. Getting out of a drawdown could take just a couple days but could also take weeks, months, years, or maybe the system broke and you’ll never get out of drawdown. That’s the hard part, not knowing when or if you’ll ever be at equity highs again. This is why it’s so important to understand your system, understand the risks, and never trade with money you can’t afford to lose. Whatever amount of money you plan to start systematic trading with, assume it’s lost forever, like you’ll never see it again, and really convince yourself it’s gone. How do you feel? I’ve started doing this exercise and it has helped me endure drawdowns. Drawdowns don’t hurt as bad if you already convinced yourself the money is gone forever. It will take time to build up the impermeable psychological wall that can endure any trading difficulty, but with some dedicated mental exercises, you can improve your psychological responses to drawdown.

Treat Systematic Trading Like A Business:

Trading is not a hobby, trading has to be thought of like a business. A hobby is something you do in your free time when you’re bored. Trading can not be thought of that way. Your systematic trading has to be tended to every day whether you want to do it or not. You have to keep placing the orders your trading system spits out into the markets every day. It is honestly tedious sometimes. There are definitely days where I really don’t care and don’t want to go run my trading systems and place the orders, but this is my business, so I do it anyway.

No business is successful overnight, and neither will your systematic trading. You will have failures, you will have losing periods of time, you will make mistakes, and that’s okay. Treat these as learning opportunities and figure out how you can become better because of them. Do not expect yourself to be rich or be making money consistently anytime soon. Have a long term goal horizon, in terms of years, because that’s the reality. It takes years of hard work to get to the point you want to be. I thought I was going to be successful in a few months, it took years, and I am still trying to grow and improve. So, set reasonable goals and manage your expectations so you don’t become discouraged and quit. Sticking with it is the only way you can become successful, the only way you fail is if you quit.

There are many things you will have to consider and have solutions for with your systematic trading business. Consider times where you go on vacation or work trips for your day job, how do you handle your trading during these times? Or what if your power goes out, or you lose internet connection, how do you handle these scenarios? These are all questions a business owner would ask themselves to ensure they have a plan for all scenarios, so you should too, make a plan.

Sometimes systematic trading is a pain in the neck. I’ve gone on vacations in a different time zone and had to wake up at 5:00am to run my systems and place my trades on my little travel laptop with a tiny screen. Before I left for vacation, I had to ensure I could access all the needed software and trading systems I need from my travel laptop. This meant transferring many gigabytes of data from my main PC to my travel laptop, then transferring the data back to my main PC when I got home from vacation. These tasks are annoying, and many times I don’t want to do them, but I do them anyway because my trading is a business.

Another business item to consider is overhead costs. Systematic trading will have overhead costs. Maybe you host your trading in a VPS with a monthly fee, or you have to buy a travel laptop so you can trade your systems while you travel. Maybe you need to buy a flash drive to backup your trading data, or a cloud service with a monthly fee to save all your data (remember, market data costs money too). These costs are all part of the game, if you are serious about systematic trading these costs are all justified. Do not cut corners. If systematic trading is something you truly desire to be proficient in, then invest the money to make yourself as likely to be successful as possible.

Investing money into your systematic trading journey also includes investing in systematic trading education. You do not have to buy trading courses, in fact a lot of trading courses are a scam or are junk, trust me I’ve bought a few. If you can find one with good reviews, the person who runs it is trustworthy and reputable, and you’ve done your research to convince yourself they are the real deal; then investing in their course could slingshot your systematic trading knowledge. I know when I joined a trading course that was actually worth a darn, I learned more in 3 months than the year I spent beforehand trying to teach myself. You wouldn’t try to become an engineer or a doctor without the proper education, so why would trading be any different?

Trust me, systematic trading is harder than you think it is, so consider the investment to learn from a reputable seasoned systematic trader. Yea courses can be expensive, but consider this, you either pay the money upfront on a quality course to properly learn the lessons on how to trade properly, or you don’t and you learn the lessons the hard way because the markets take all your money. Either way you pay the fee, it’s just a matter of how you prefer to learn the information, one method is way easier psychologically than the other, so consider the investment in education.

Conclusions:

I hope this article has helped guide you in terms of where you should start with your systematic trading journey. There is no wrong answer of where to start, but there are some paths that are easier than others. Take the path of least resistance for you and grow and expand from there. Nothing has to be perfect in the beginning, the most important thing is at some point you actually start systematically trading live so you can gain that real market experience. You’ll never be successful unless you take that leap and start trading live as soon as you can. Also, don’t skimp out and cut corners on necessary costs and be sure to treat systematic trading like a business. Focus on tiny improvements everyday and one day, a couple years from now, you won’t even recognize yourself or your trading portfolio because you’ve made so much progress.

Thanks for reading, if you have questions about getting started with systematic trading feel free to reach out to me via Substack or X. Even if you have plenty of experience about systematic trading, feel free to reach out anytime, I love having discussions about systematic trading.

Great article!

Wonderful article. I'm sure it will help many.