Trading System Investigation Series 3

Outperform The S&P 500 With This Simple Set Of Trend Following Systems

Welcome to the “Systematic Trading with TradeQuantiX” newsletter, your go-to resource for all things systematic trading. This publication will equip you with a complete toolkit to support your systematic trading journey, sent straight to your inbox. Remember, it’s more than just another newsletter; it’s everything you need to be a successful systematic trader.

Introduction:

I don’t know about you, but I’d like to outperform the S&P 500 over the long term. Outperformance can be on the absolute returns or the risk adjusted returns (or both). In this article, we are going to explore a trading system that has delivered slightly better than S&P500 returns with less than half the drawdown.

The S&P 500 delivers decent returns, 8%-12% over the long term, depending on the lookback window you analyze. I’ll take the 8%-12%, no problem, no complaints there; 8%-12% compounding over, say, 30 years is a very attractive number.

To show the power of 8%-12% compounding, a starting account value of $1,000 with $500 added per month for 30 years results in over a million-dollar portfolio after 30 years:

And if we get more aggressive, we’ll end up with even more capital at the end of the simulation. Instead of saving $500, if we save $1,000 a month into the S&P 500 for 30 years, we end up with a two-million-dollar portfolio:

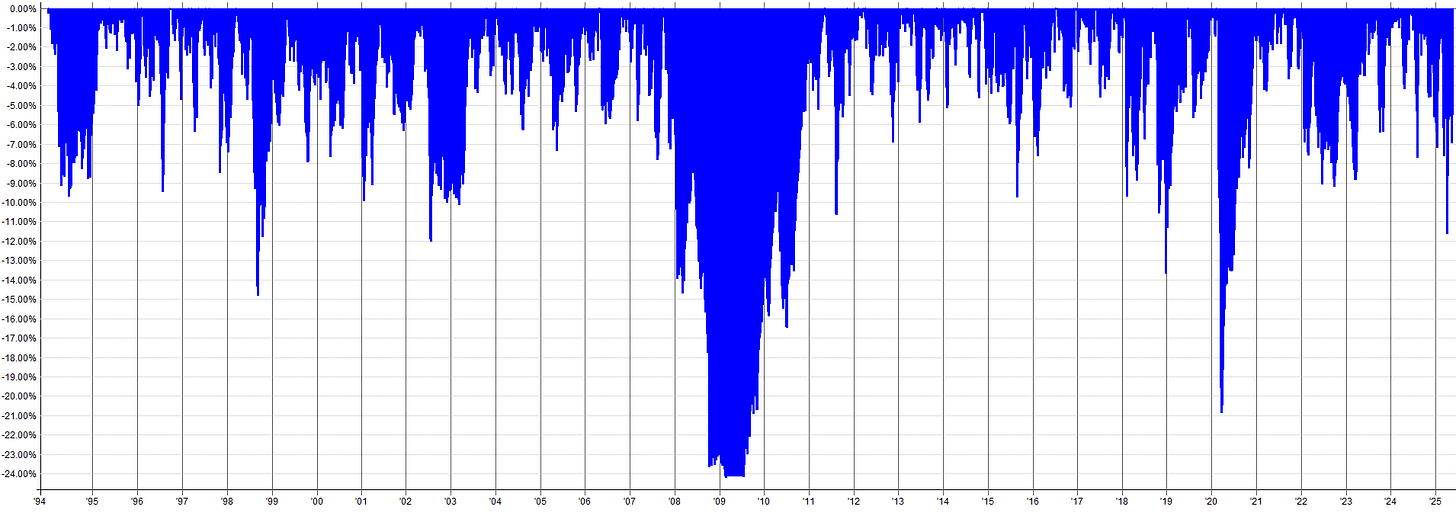

So, side note: if you’re a young guy or gal, start investing now! Anyway, I can live with an 8%-12% compounding return. What I refuse to put up with is the volatility and hardship involved in getting there. The S&P 500 has had some very scary years historically, and with near 100% certainty, these scary years will happen again in the future.

Take a look at the plot below. This is a long-term view of the S&P 500’s performance. Up and to the right, yes, but also massive drawdowns and volatility along the way. The gray regions are historical recessions.

These drawdowns and volatility events are what scare investors off. They’re what cause investors to panic-sell at the bottom, destroying their compounding growth and their future.

There has to be a better way. How can we secure our 8%-12% without the volatility and drawdowns? If we can create a smoother ride for ourselves, we’ll be able to stick with our investment and be less likely to panic-sell at the worst possible time.

That’s exactly what this article will cover. I’ll go over a trading system specifically designed to capture real market factors in a way that results in S&P 500-like returns or better, with under half the drawdown. On an absolute return basis and a risk-adjusted basis, the trading system we will explore has outperformed the S&P 500 over the long term. Also, this trading system would serve as a fantastic backbone system for any serious investor’s or trader’s portfolio.

In this article, I will cover the following:

Where I found the initial idea for the system

How I went from an initial idea to a final trading system

How the system works

How this system could contribute to a portfolio of other trading systems

The trading system code

Let’s dive in…

Introducing The System:

Before we get too far, let me show you where we’ll end up. This is the system I’ll share in this article. Well, technically it’s two systems; both follow a similar premise, but they capture two different market factors. The green line and red line are the two individual systems capturing two different market factors; the dark blue line is the combined performance of the two systems when traded together:

For deeper learning opportunities in systematic trading, consider signing up for the Systematic Trader School.

📈 This will consist of 10, 1-on-1 consulting sessions with me! By the end of the 10 consulting sessions, you’ll have a robust portfolio of 3–5 designed, developed, and implemented systematic trading strategies.

🥇 These aren’t theoretical trading strategies—you’ll develop real, tradable strategies for use with your trading account.

🚀 I’ll guide you step-by-step, from planning your portfolio and developing your own trading strategies, to conducting robustness testing and implementing the portfolio live.

📚 To learn more, check out the Systematic Trader School page. Also, you can book a free 30 minute consultation. During the call, I’ll explain exactly how it works and the transformation you can expect:

👉[Click here to learn more about the Systematic Trader School!]👈

👉[Click here to book a free 30 minute consultation!]👈