TradeQuantiX Portfolio Update: 9/10/2024

How the portfolio has held up since the August volatility event

Not too long ago, the US markets had a little volatility fit. Just 4 weeks ago the SPY dropped by about 10% pretty quickly. The SPY hit all time highs, pulled back slightly, had a little bounce back up, then decided to drop pretty aggressively over the course of 2-3 days. Here is a chart of what the SPY looked like:

Not necessarily the worst thing that could happen, but definitely not an enjoyable experience (unless somehow you managed to short this move, in which case, congratulations that’s impressive). I did not catch any shorts from this move on the way down because the initial pullback wasn’t deep enough to trigger any of my short systems, and the second pullback was too quick to allow any time for short entries to trigger during the selloff.

By the time the markets were fully sold off and at the bottom of the pullback, my hedging system kicked on, perfect timing (not!). I guess it’s better to be hedged than not in these instances. Here’s what that looked like:

My system bough the top of the VXX, so much for a hedge. I was not too worried though, because if the markets continued to sell off I was in a good position to profit from further sell offs; that’s just not what happened this time. Instead we ended up getting a “V” shaped recovery bounce out of the bottom of the sell off. This recovery is where I made my profits.

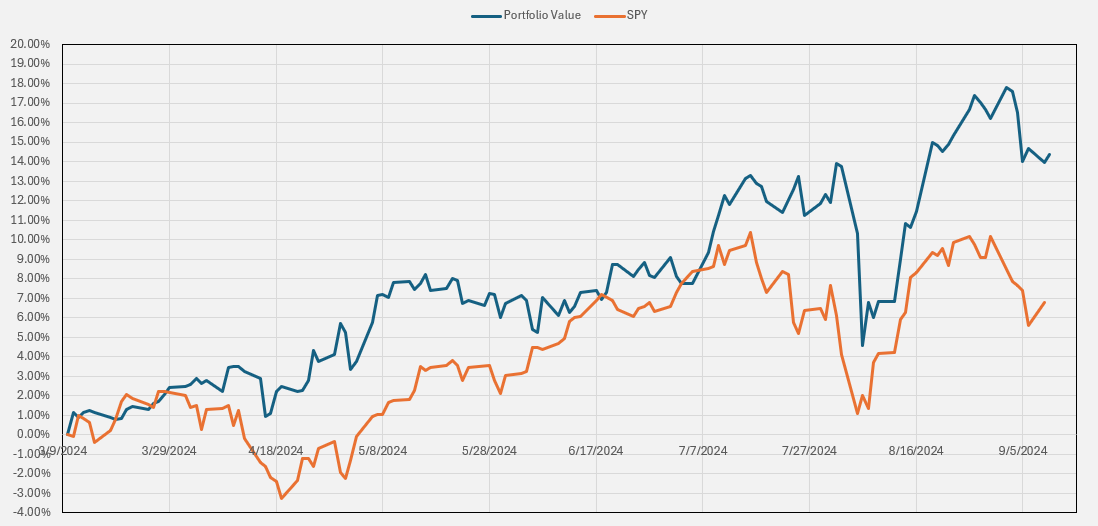

Most of the long side of my portfolio are momentum and trend following type trading systems. These types of systems tend to buy and hold the strongest stocks in the market. When these quick market sell offs happen, the stocks in the trend/momentum systems also sell off but when there is a fast recovery market wide, the stocks held by the trend/momentum systems rally up even harder. Due to the mechanics of how trend/mometum systems work during fast recoveries, I was able to recover very quickly from this market sell off and get back to all time highs. See my portfolio equity curve vs. SPY below:

You can see where the selloff happened in August in my portfolio (blue line). My portfolio of trading systems held up to the initial market pullback, but when the quick dump happened, my portfolio also dropped pretty quick. I actually remember this day pretty well, I logged into my computer and saw I was down 5% overnight. Most people would freak out to see this. My computer screen was completely red as nearly every stock I owned was down. Though this situation wasn’t very fun, I was actually able to retain my composure, which I am very proud of. See my tweet below about the day of the sell off:

I was pretty proud of my ability to realize this is just part of the game. These things happen, you can’t expect to win in every scenario. You should be trading with a mindset in the horizon of years and decades, not day to day. Day to day moves are just noise, anything can happen, it’s the long term that matters.

What this volatility experience opened my eyes to is:

It seems like I am well positioned for market recoveries

It seems like I am well positioned for very deep market selloffs/crashes (more than the 10% we saw).

On the other hand, it seems like my portfolio has a missing component of profiting from medium sized selloffs of around 5-10%, like in this case. This will need to be a place of research for me in my strategy development so I can fill this gap in my portfolio.

While I survived then thrived from this volatile move in the markets, it was a little eye opening for me. Not only was it eye opening because it pointed out a weakness in my portfolio, but also because just a couple weeks before I was looking into a short volatility trading system. If you’re unfamiliar, short volatility collect profits when the markets are non-volatile, in other words when the markets are behaving a short volatility systems make money. When the markets misbehave, a short volatility system gets wacked, and usually pretty hard. Think about it like picking up pennies in front of a steamroller, yea you’ll make some consistent money, until you get run over.

Here is the system I was working on just a couple weeks before the high volatility event:

Is this system that great? No, I was just in the beginning stages of development, but it shows the hidden dangers of shorting volatility. Just a couple weeks after starting to develop this system, it hit a new worst case draw down of 36%, which is much worse than the previous worst case draw down of about 17%. Not only does this show the dangers of shorting volatility, but also how easy it is to curve fit out poor performance in a backtest. This backtest managed to go 14 years without a major hiccup, then the second it starts sitting in live incubation it has double to worst case draw down. In the trash this system goes. In the future I will have to write an article about how easy it is to curve fit poor performance out of a trading system without even realizing it.

To Do list:

Create a trading system to profit from smaller 5-10% sell offs

Don’t trade short volatility

That’s all for this weeks journal, hope you enjoyed the first of this series and maybe it gives you a couple things to look into with your own portfolio.

"In the trash this system goes" lol - Yeah, it's easy to curve fit them. Vol based systems are difficult because of the way the options markets have evolved over time. I stopped using Vix based stuff back in June 2022. Do I look at it still, yes. but I like using things like the Nations Indexes now (the TDEX, the SDEX, and the VOLI). Now that 0DTE Options are running the show most days, it pays to look at that stuff too.