It hasn’t been too eventful since the last time I had a portfolio update, but there are some things I would like to talk about. I made a few mistakes in the last few weeks that need to be discussed. My portfolio PnL has also settled down a bit from the run up it had in August through October. So let’s jump into the update.

Mistakes:

I made a few mistakes the past couple weeks. There were two instances where I forgot to place my orders. In one instance I just completely forgot to run all my trading systems and I didn't get around to running the systems and placing the orders until an hour after the US markets opened. In the other instance I ran my systems but I left for work before I placed the orders in the market. I've been systematically trading with my current framework for about 2.5 years and the number of times I have forgotten to complete my trading in the morning I could count on one hand. Two of those instances happened in the last two weeks.

I attribute forgetting to complete my trading to my day job. The past couple of months at work have been hectic and have distracted me from my trading. Luckily, all the fiasco's at work seem to be dying down. To combat the lack of focus I've had on my systematic trading I decided to take Friday off and use one of my personal days. I need to refocus and do a deep examination of the current positions I own. This needs to be done to ensure that missing two days of trading hasn't caused my positions to become out of whack (due to missing entry or exit signals).

All of my systems are coded up and I can simply double click a executable and it will run all of my systems and generate their orders. Once all the orders are generated, I have a second piece of software that reconciles all of the orders and then I can press a button to push them to my broker. So, even though my process is 90% automated there is still 10% that has a human component which requires a couple minutes of work. A lot of people think systematic trading is “set and forget”, meaning once the trading systems are running you can just let them run and don't have to check up on them. This is not the case. As you can see there is still a small amount of human intervention that is required every day and if this 10% of work is not completed or is forgotten about, then it in can cause massive problems with the trading portfolio. Though a lot of systematic trading involves automation, there are always some components that will require manual work, whether that's reconciling orders, placing orders, validating the systems working properly etc. there is always something manual that needs done. If there is something else in your life that is distracting you and preventing you from doing the manual work, then that can wreak havoc on your systematic trading.

Anyway now that I've gotten my two big mess ups off my chest, there's one more issue I want to discuss. There was a stock in the past two weeks that went up over 750%. The stock ticker was called DRUG. See the image below (I had to put it in log scale to actually see the move):

One of my shorting systems gave me an order to short the stock. I was aware of this stock and its crazy moves from people posting about it on X. So when I saw the order signal to short DRUG, I deleted the order so it wouldn't be placed in the market. In hindsight, it didn't matter because my broker didn't have any short stock to borrow, but I overrode my system and did something different then what the backtest said to do. This was an emotional decision, I felt scared because if I shorted this stock and it continued to go up hundreds of percent, then that would hurt my P&L. From a risk management perspective this may have been the right thing to do since moves like this don't tend to happen too often historically. But on the other hand, I have a strong belief that I should never override my system. If I find something that is inherently wrong with the system, I should fix the system such that it doesn't happen again in the future. Thus, I plan to look into adding a rule that prevents the system from shorting stocks that have gone up multiple hundreds of percent in one or two days, like DRUG did.

Current Performance and Positions:

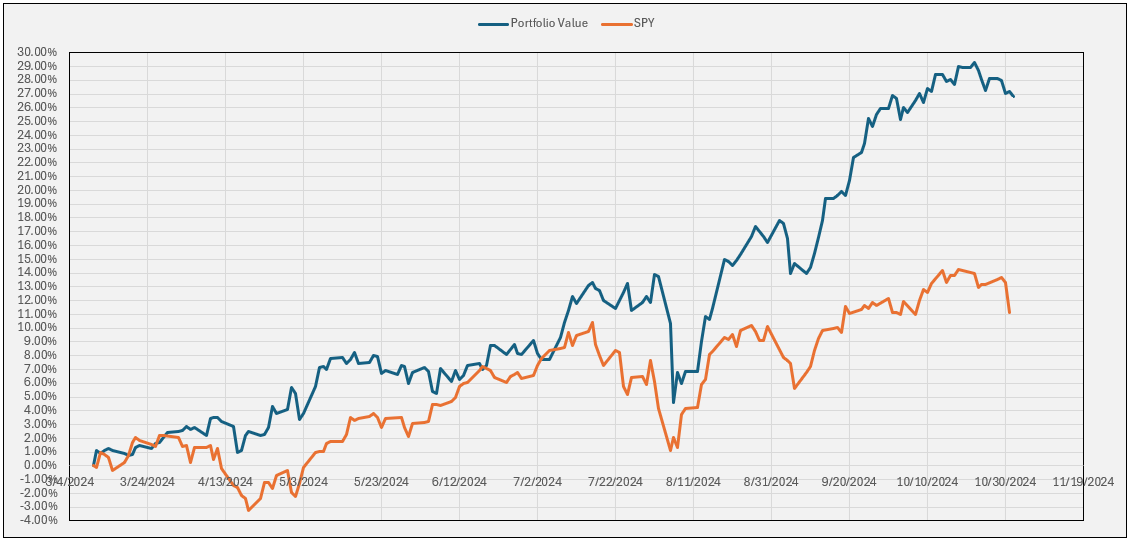

Alright that's enough about the mistakes and emotional decisions I've made in the past couple of weeks. Let's look at my current performance as well as some of the main positions that I'm in right now. I have updated my P&L equity graph below.

As you can see, in the last couple weeks I've had a little bit of sideways chop and in the last couple days I've gone into a drawdown of a few percent. This is expected, especially after the massive run that the portfolio had the past couple months. Honestly, I think my portfolio may chop sideways or go into a larger drawdown for the next month or two. But this is just my speculation, it doesn't mean anything, I'm going to continue to trade like I always have.

Another thing interesting to note about my portfolio, my hedging system has turned on with 1/3 size. This system is actually wrong most of the time, so I don't necessarily foresee some big sell off happening, but it's good to know that if something does happen I am hedged. This hedging system focuses on profiting during periods like 2000, 2008, 2020 etc. This system takes signals based off the VIX, and the VIX looks like it's starting to go higher. So, if the VIX takes off at least I am hedged, but if the VIX settles back down then I'll take the small loss. That’s the cost of having insurance. See below for a chart of the VIX:

In other news, I still have a few open positions that are killing it. These three trades are some of my biggest winners right now:

That's all for the update this week. As you can see I'm not perfect, I make mistakes, I still get impacted by emotional decisions. Onwards and upwards as they say, let's finish out the year strong. My goal is to have zero mistakes for the last two months of this year. This should be doable considering that the number of mistakes I've had in total this year I could count on one hand. I just don't like how multiple of them happened in such a short time span. Anyway, happy trading!

Why would you deploy that strategy when the beta it’s probably 1 or just slightly higher instead of just buy and hold SPY with leverage? You would significantly avoid transaction cost and taxes which probably eat up all your alpha if there was any

Sharing ones trading performance is akin to letting someone look into your soul. Thank you for the content.