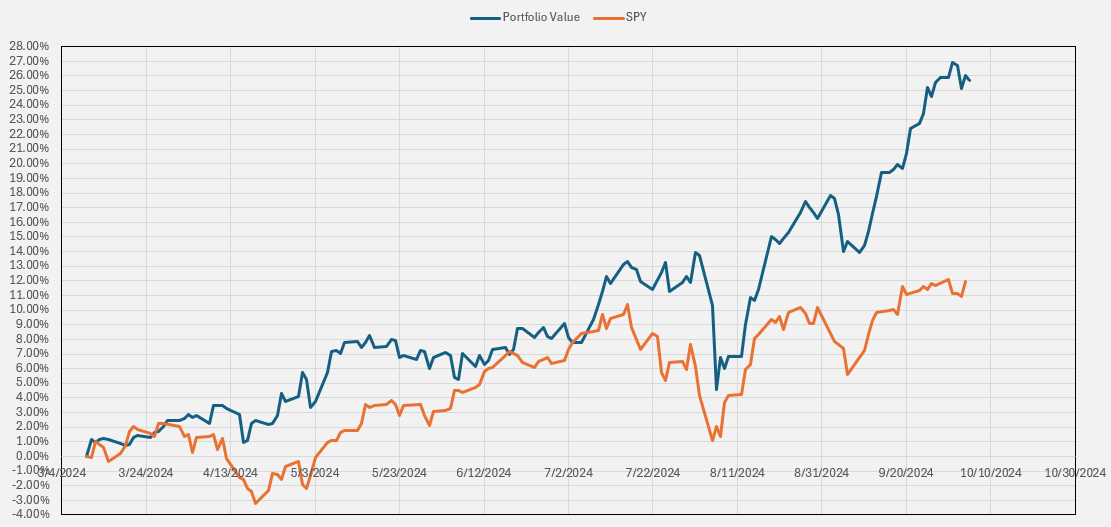

Sheesh, it has been a pretty crazy run for the portfolio in the past month. I’ve seen some crazy outperformance and it’s been awesome and exciting. But, at some point it has to come to an end, this can’t last forever.

I’m definitely overdue for a pullback in the portfolio, and I think it’s in the beginning stages of a pullback now. There’s no tell tale sign that the portfolio pull pack is starting now other than a little blip at the top of the equity curve; but who knows, maybe it turns back up and keeps going. Either way, I’m just going to keep trading my systems and managing my expectations and psychology.

See what I mean? That’s a crazy run up in equity. Between you and me, I’d love for that number on the Y axis to hit 30% by the end of the year, but I need to manage my expectations so I’m not let down. This thought is my greed getting the best of me.

In my eyes, there’s two flaws to a traders psychology. One flaw is fear and making rash decisions when times are tough and losses are abundant. The other flaw is greed and the desire for more, more, and even more when times are good. Well, for my portfolio, times are really good right now and it’s very difficult not to feel the greed. I have found myself in thought experiments like: “If my portfolio continues growing at this rate for another month then I’ll have this much more money in my account!”. I have to snap myself out of those thoughts because when the inevitable drawdown comes, it makes it that much harder to deal with.

I think of trader psychology like I think about portfolio construction. If you construct a portfolio to be high risk high reward with lots of volatility, your psychology is going to be very volatile as well, thrashing between fear and greed every week. On the other hand, if you build a stable portfolio then your psychology should be stable as well. I’m trying to keep my mind stable. I am trying to not let my greed overtake my mind because the less greedy I am now, the more dampened the fear will be once the drawdown starts. A stable psychology is the way to go but it’s hard to have sometimes. Anyway, I’m working on it by trying not to think about trading in my free time.

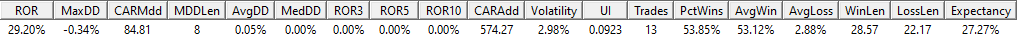

As part of the process I do every week, I check on my live system performance and ensure everything seems with expectation. Most of my systems have been performing well the past month, but I have one system that stands out above the others. The performance of this system has been insane since I launched it live in June, like astronomically insane. Here are the stats based on real live trades since the system started:

And the equity curve is wild too:

Obviously, long term this isn’t sustainable, 29.20% CAR with a 0.34% max drawdown, but it’s definitely fun to watch right now. Just a good example of timing luck when starting a system. Most of the time when you start a new trading system you immediately go into drawdown, this time it just happened to go the other way for me.

Anyway, here’s a look at some of the recent winners:

These are three different stocks, but looking at the price patterns they all are correlated with a massive price jump in mid august. Granted these trades are all from one system so maybe that’s expected. Goes to show, sometimes correlation can be good thing, if it’s going in your favor… we will see how long that lasts. ‘Til next time!