Welcome to the “Systematic Trading with TradeQuantiX” newsletter, your go-to resource for all things systematic trading. This publication will equip you with a complete toolkit to support your systematic trading journey, sent straight to your inbox. Remember, it’s more than just another newsletter; it’s everything you need to be a successful systematic trader.

Introduction:

Over the past few months, the most common question I have been asked in terms of systematic trading is:

“How do you allocate capital to your strategies when running a multi-strategy portfolio?”

If you have one trading system, capital allocation is pretty simple: 100% of capital is allocated to the system.

If you have two trading systems, maybe you just opt for a simple 50/50 split of capital.

But, once you have multiple trading systems, capital allocation can become much more daunting.

Is equal weight allocation the best?

Is there some secret sauce to portfolio capital allocation I don’t know about?

What if I miss something, mess up my allocation, and my portfolio suffers as a result?

There is a lot of second guessing that happens during portfolio level capital allocation. To help with this, I want to walk through an eight step process that provides a sensible, simple, yet very effective approach to portfolio capital allocation.

Example Systems Used In This Article:

I am going to walk you through each of the eight capital allocation steps with an example portfolio. Thus, I need some example systems.

For this article, I leveraged five systems that we developed as part of the Portfolio Development Series; which we spent a lot of time on in 2025. Within that series I did cover portfolio capital allocation, but in this article I want to dive much deeper.

I will give a more in-depth, step-by-step framework on how to perform portfolio capital allocation which blends everything together that was discussed within the Portfolio Development Series.

To get more information about portfolio construction, consider checking out these two articles:

Let me introduce the five systems I will use to build a portfolio. The five systems are:

System 1 - US Mega Cap Mean Reversion

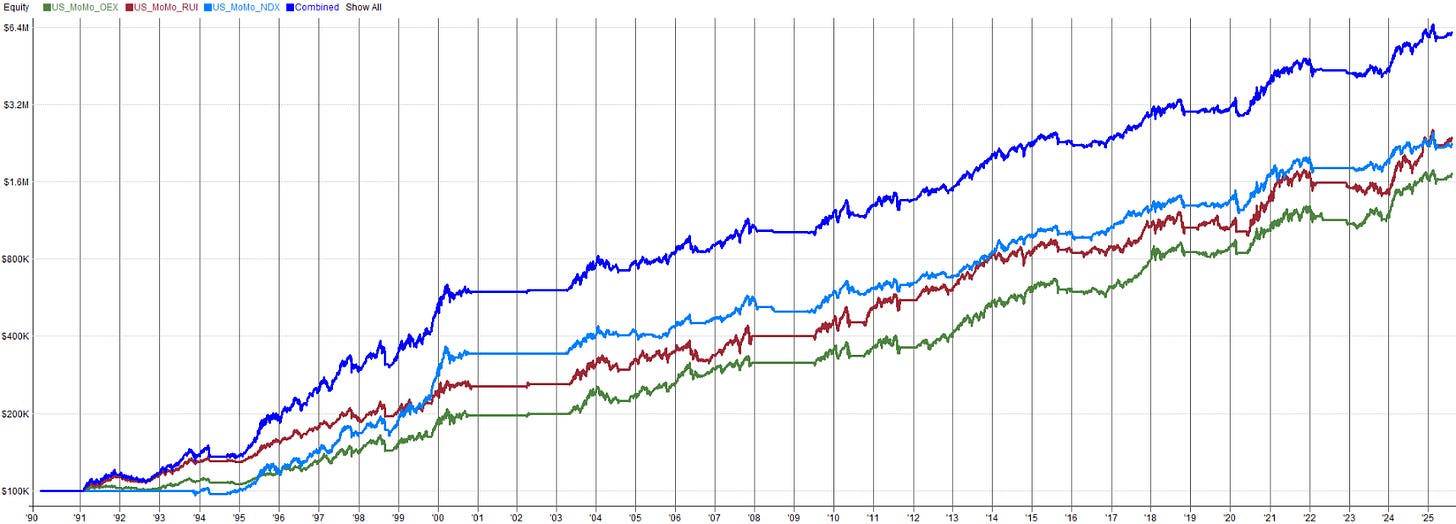

System 2 - US Mega Cap Momentum

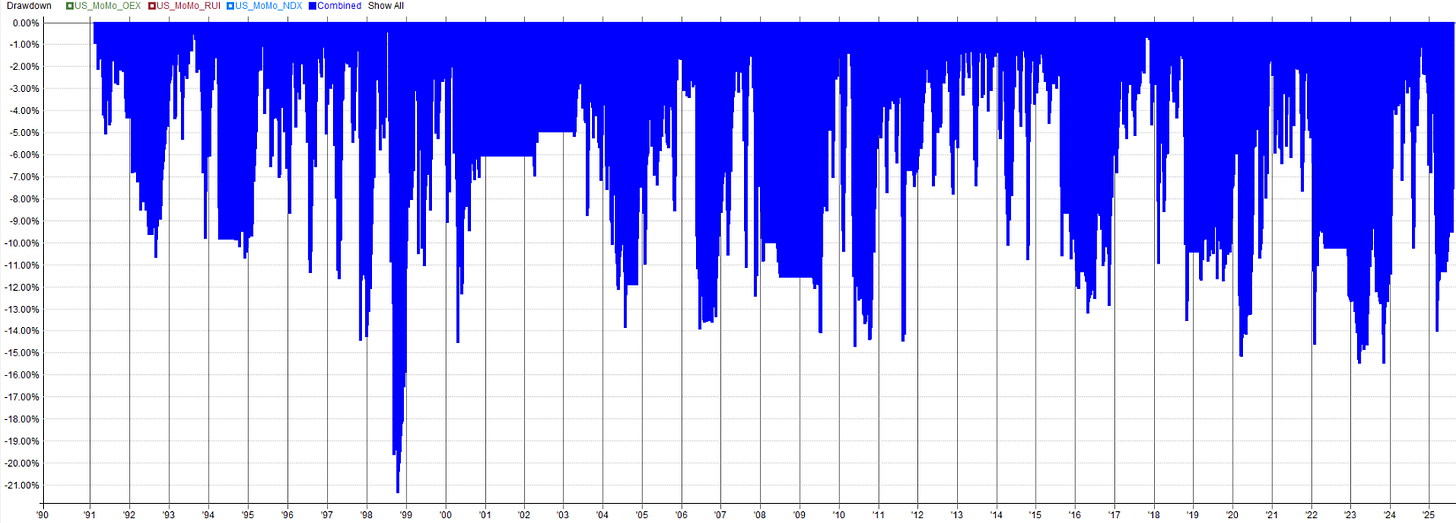

System 3 - ASX Small Cap Trend Following

System 4 - TSX Momentum

System 5 - Long Volatility Hedging

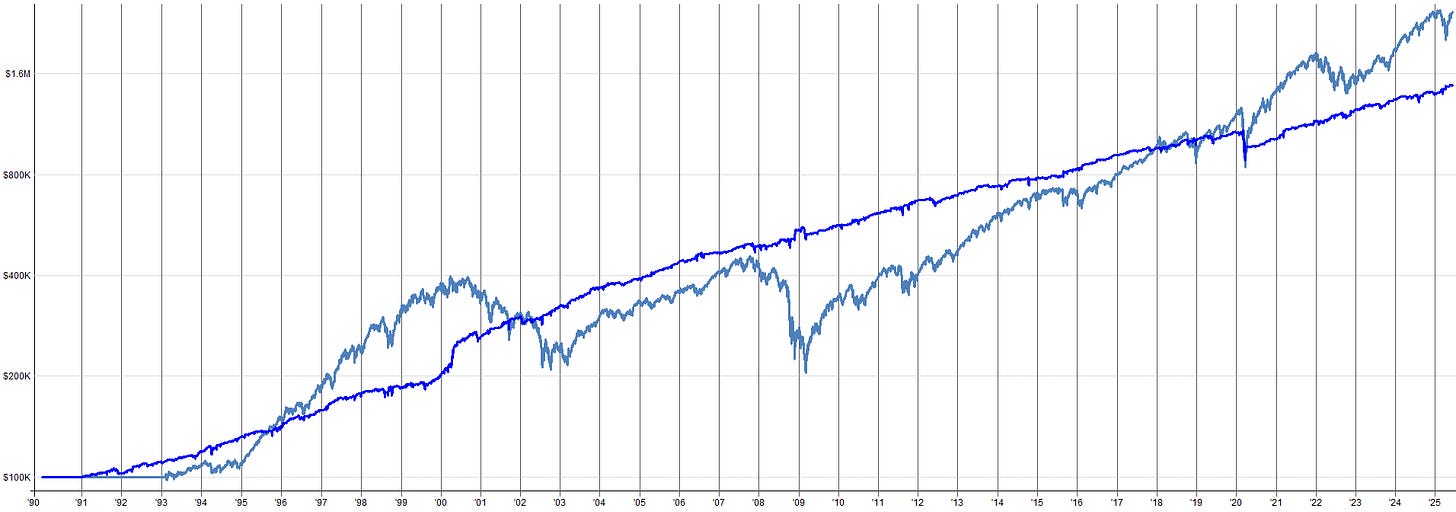

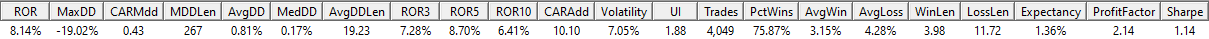

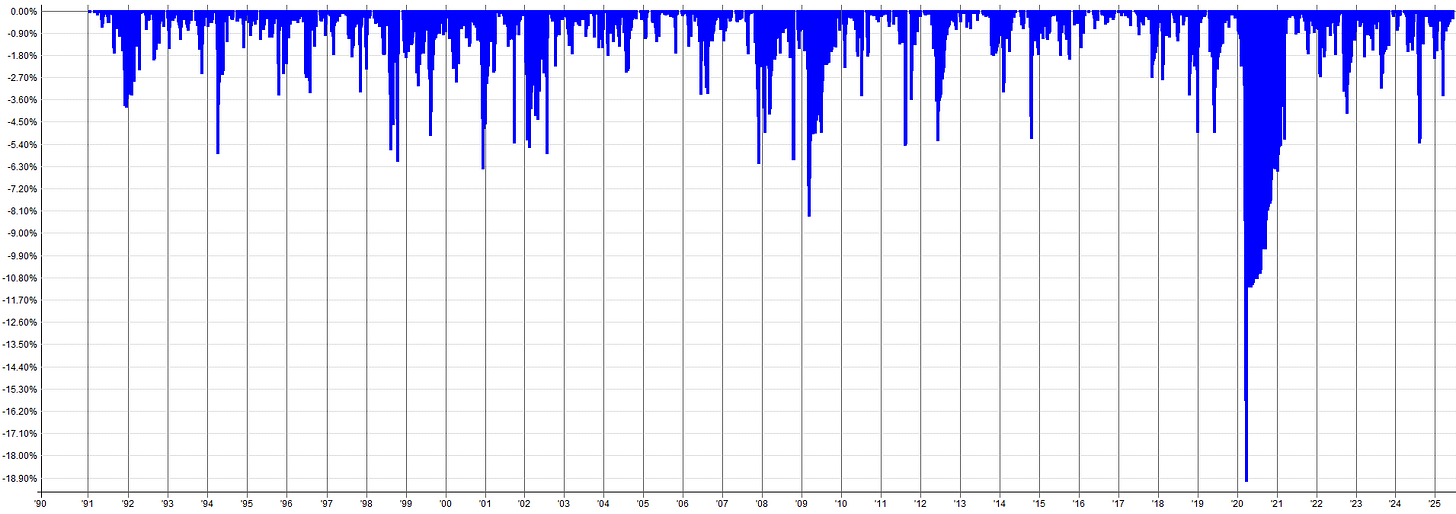

You can see the results for each of the systems in the images below. I’ve also linked the articles where we developed these systems if you want more background.

System 1 - US Mega Cap Mean Reversion:

System 2 - US Mega Cap Momentum:

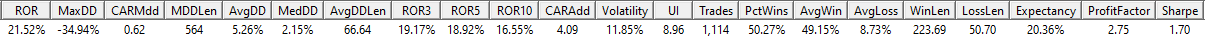

System 3 - ASX Small Cap Trend Following:

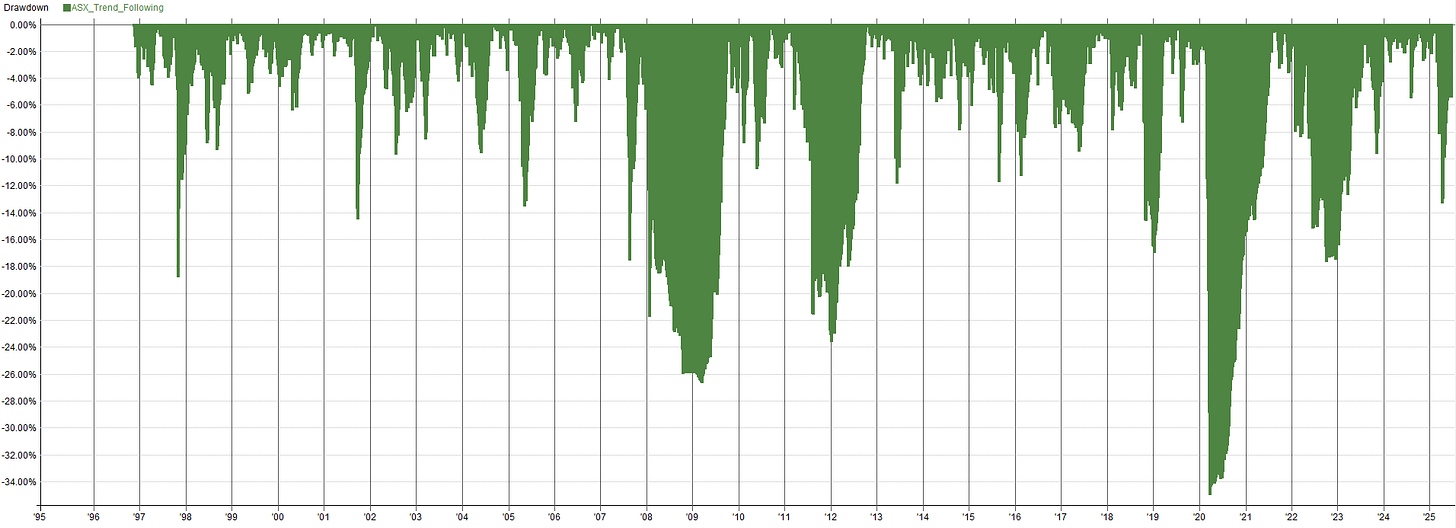

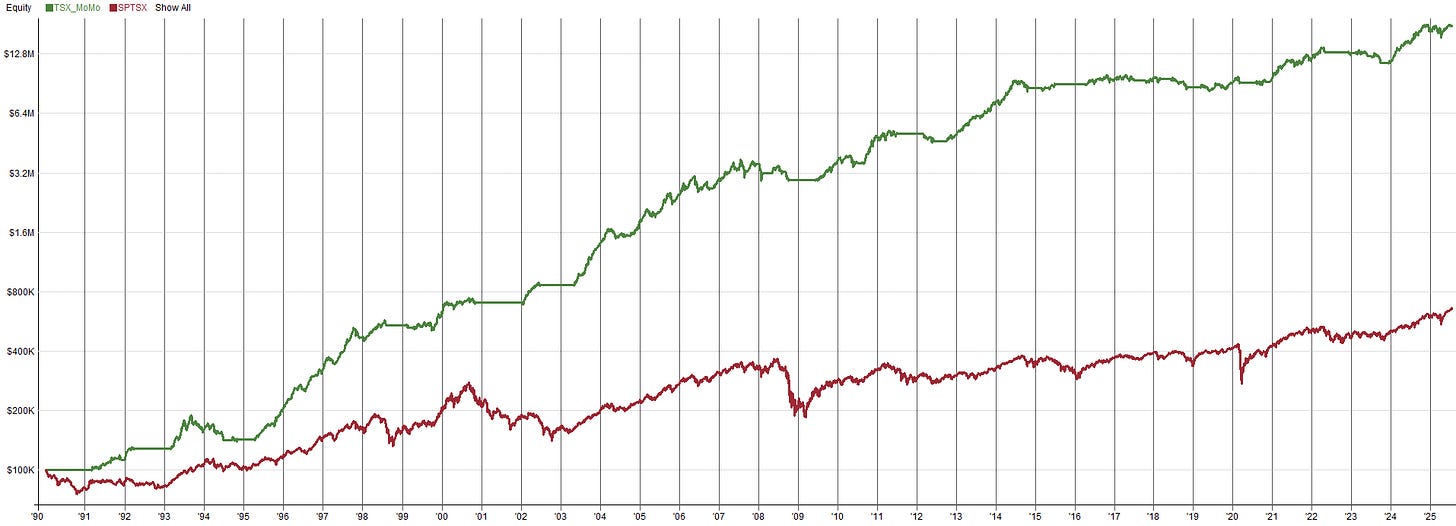

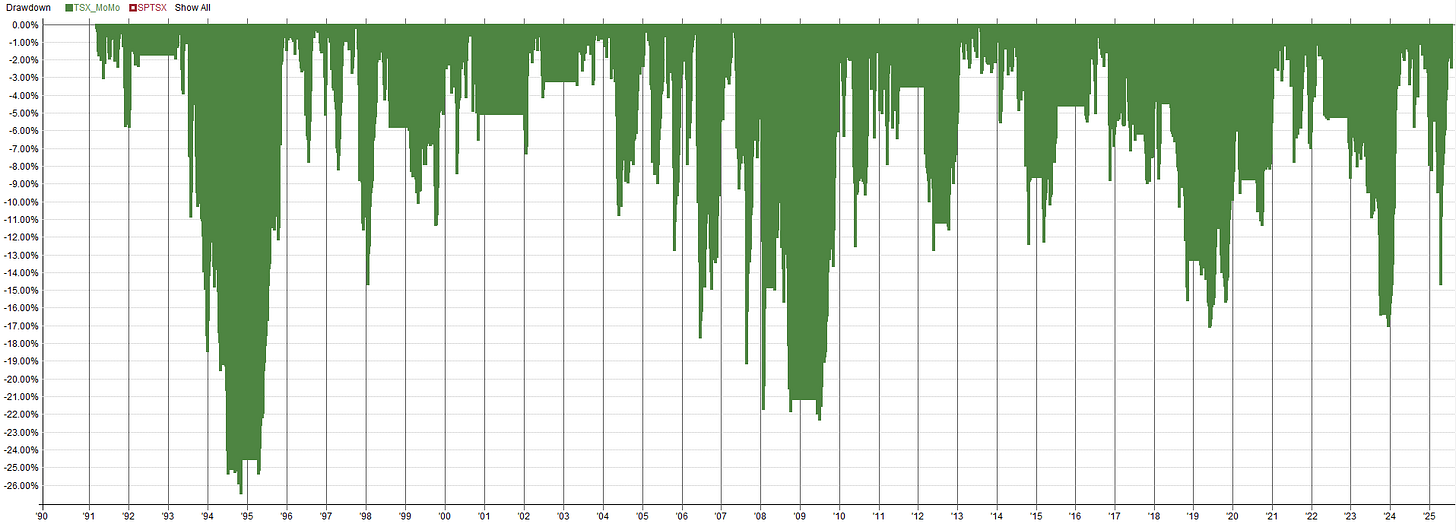

System 4 - TSX Momentum:

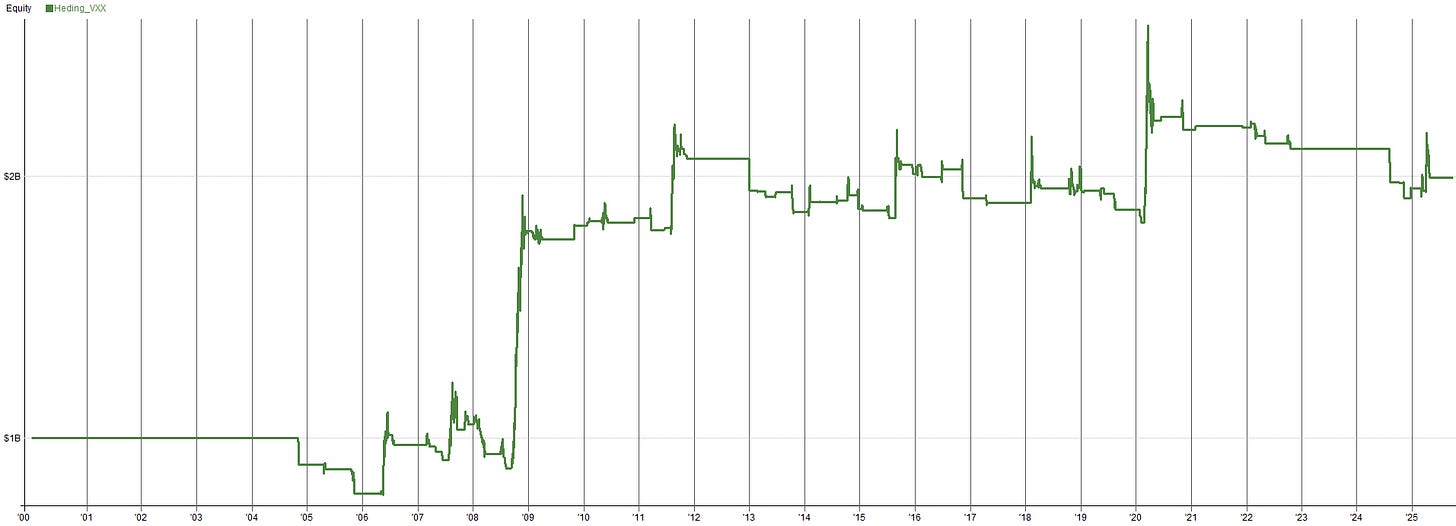

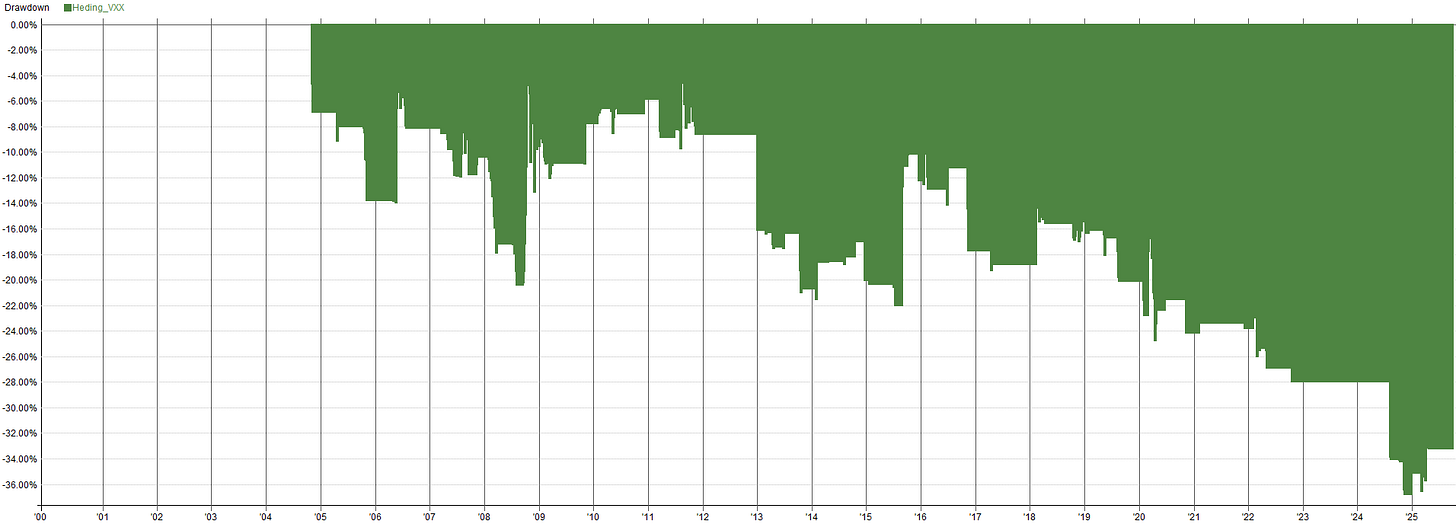

System 5 - Long Volatility Hedging:

Portfolio Allocation Steps:

Let’s get right into the step-by-step framework for sensible capital allocation within a multi-strategy portfolio. Like I mentioned, this implementation is straight forward but very effective.

Don’t get bogged down in super intense optimizations or super complex techniques. We want simple and effective, not complex an confusing.

We do not work for large hedge funds.

We do not have a team of PhD’s to work out the absolute optimal perfect allocations.

We are generally independent retail traders who just need the simple, yet effective, 80/20 solution. And that’s exactly what we are going to cover here.

The eight step multi-strategy portfolio capital allocation framework is summarized below as follows: