Case Study: Dividend Investing - Part 1

A study on if dividend investing works

Introduction:

I’ve always wondered, does dividend investing actually work? All my life I've heard from investors that dividend paying stocks are always good. A stock that is increasing in value while also providing a consistent paycheck along the way, how could one complain about that? It seems like a pretty sweet deal to be able to collect a consistent paycheck from being invested in a company, but there has to be a catch. Today let's dive into dividend investing and understand the general philosophy, how it works, when it's beneficial and when it's not, and try to give you a better understanding of dividend investing so you can decide if it’s for you or not.

What Are Dividends And How Do They Work:

A dividend is one way a company can pay you, the shareholder, a portion of the company's profits/earnings. Some companies choose to reward their investors with quarterly or semi annual dividends as a payment for investing in their company. Not all companies pay dividends though, some companies choose to reinvest the money back into the company to expand the companies growth. The company reinvests what would be a dividend back into itself to accelerate growth, and thus the investor is rewarded with a faster growing stock price (the company could make poor business decisions and hurt the stock price, but this goes for any company, dividend paying or not).

You may be thinking “OK that's cool, wouldn't I want to be buying companies that pay dividends? Isn't that just like free money?” Not exactly. You can't just pull money out of thin air, the money the company is paying you via dividend is coming out of their own pockets. The dividend the company pays you will be reflected in the stock price, making the stock price drop. So, if a company pays a $0.50 dividend per share, then the stock price will drop $0.50 to reflect the cash payment to the investors. In reality you end up net zero, the stock price drops $0.50 so you lose $0.50 a share but you gain a $0.50 per share dividend in cash. You may be surprised how many people don’t realize this happens. See the chart below illustrating this point. This stock paid a dividend of about $0.75 and the stock price dropped that same value of $0.75. Note that the drop isn’t exactly $0.75, there is some pre-market and after hours price fluctuation that can cause the price delta not to add up to exactly $0.75.

The blue spikes on the bottom pane represent days there was a dividend paid to the investor. You can see in the zoomed in plot (second image) during January of 2024 the price dropped from $29.45 at the close to $28.77 at the next open, a drop of $0.68 when the dividend was $0.75. Like I said the delta isn’t perfect due to pre market and after hours market fluctuations, but you can see how the dividend was taken out of the stock price.

Benefits Of Dividend Paying Stocks:

So if dividends just end up as a wash then what are some of the benefits? Say you had a large sum of money invested in a stock/ETF but needed some of that position liquidated into cash for a purchase. Either you could wait and collect the dividend (assuming the dividend would be enough to cover your purchase), or if the stock did not distribute dividends then you would have to sell shares. This is one of the big advantages of owning stocks that pay dividends, the frequent payouts without having to sell any of your shares.

Let's illustrate this benefit with a simple example. Consider two people of retirement age living off of their investment portfolios. One of them has all their money invested in SPY, which pays a small dividend but maybe not enough to live off of. While the other is invested in SCHD, which is a high dividend paying ETF. Let's assume both of these investors have $1 million saved and invested in their portfolios. Now let's assume both of these investors retired and are living off of their portfolios right around the start of the 2008 financial crisis. SPY and SCHD are both hammering downwards as the bear market accelerates. The value of both of their portfolios are dwindling lower and lower. The problem is both of these investors live off of their portfolios and even though the bear market has started and their portfolio values are dropping, their costs of living remain constant. So, the first investor has to sell a certain amount of shares of SPY every month so that they can have cash to pay their bills and living expenses. The second investor, the dividend investor, can simply collect the consistent dividend payments paid by SCHD and not have to sell any of their shares. This is an interesting concept because when you are forced to sell shares at a loss, you are realizing that loss and decreasing the value of the overall portfolio. Whereas if you can avoid selling because you are collecting dividends, you are not realizing any losses and once the market snaps back you regain the full value of your portfolio. See the examples below to illustrate this point.

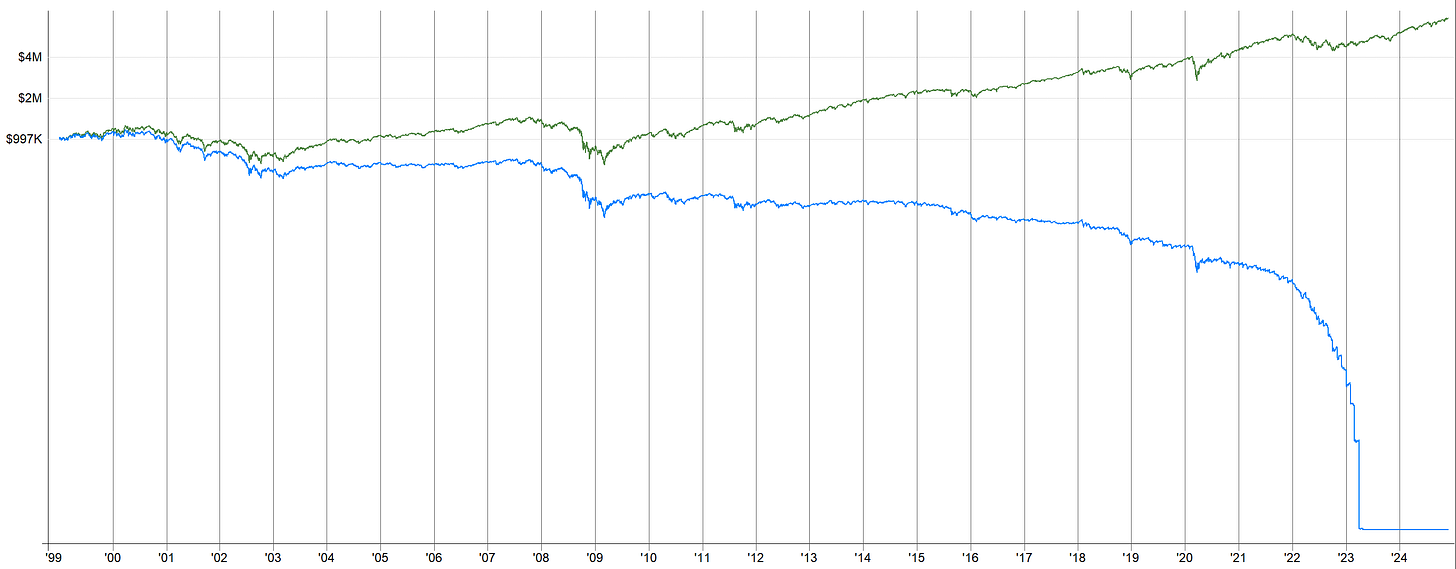

This first plot is of SPY from 2007 onwards where the investor has 1 million invested and sells $5,000 a month to cover living expenses (green is SPY where nothing is sold as a benchmark, blue is what the investor sees when they sell $5,000 a month):

As you can see, retiring right before a bear market and selling shares for income can be painful in the long run. It took until about 2020 to regain the initial 1 million dollar account balance, then they were smacked by the Covid bear market. Yikes!

This second plot is of SPY from 1999 onwards where the investor has 1 million invested and sells $5,000 a month to cover living expenses (green is SPY where nothing is sold as a benchmark, blue is what the investor sees when they sell $5,000 a month):

Wow, this is even worse. Buy luck of the draw, this retiree experienced two terrible bear markets within the first 8 years of retirement. Their expenses remained the same, so they kept taking out $5,000 a month to cover their bills. Sadly, they eventually ran out of money. This is why it is important to ensure you have enough saved so you are covered even if a worst case scenario in the stock markets happen.

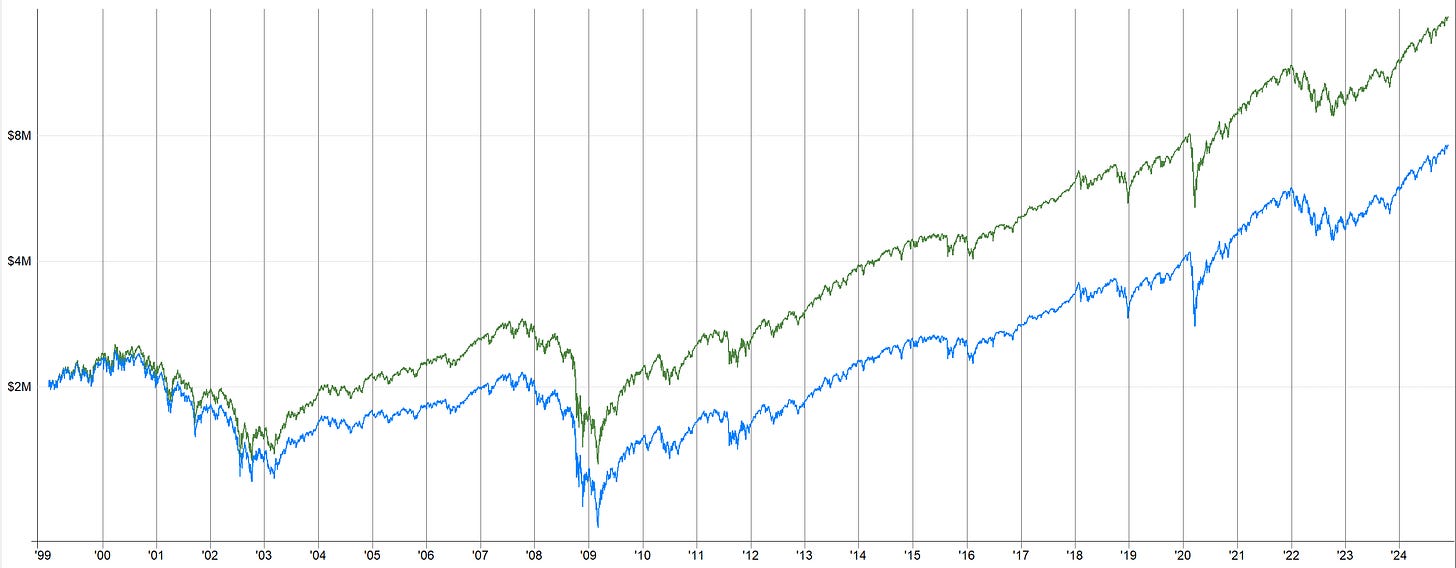

This third plot is of SPY from 1999 onwards where the investor has 2 million invested and sells $5,000 a month to cover living expenses (green is SPY where nothing is sold as a benchmark, blue is what the investor sees when they sell $5,000 a month):

See, now the investor has enough money (2 million as opposed to 1 million) to survive through two bear markets. Things to consider are: the initial account size matters, the size and consistency of the withdraws matter, the amount of time the income from the portfolio is needed matters. These are all things to take into account when selling shares to fund your retirement. This is the drawback of selling shares as an income strategy.

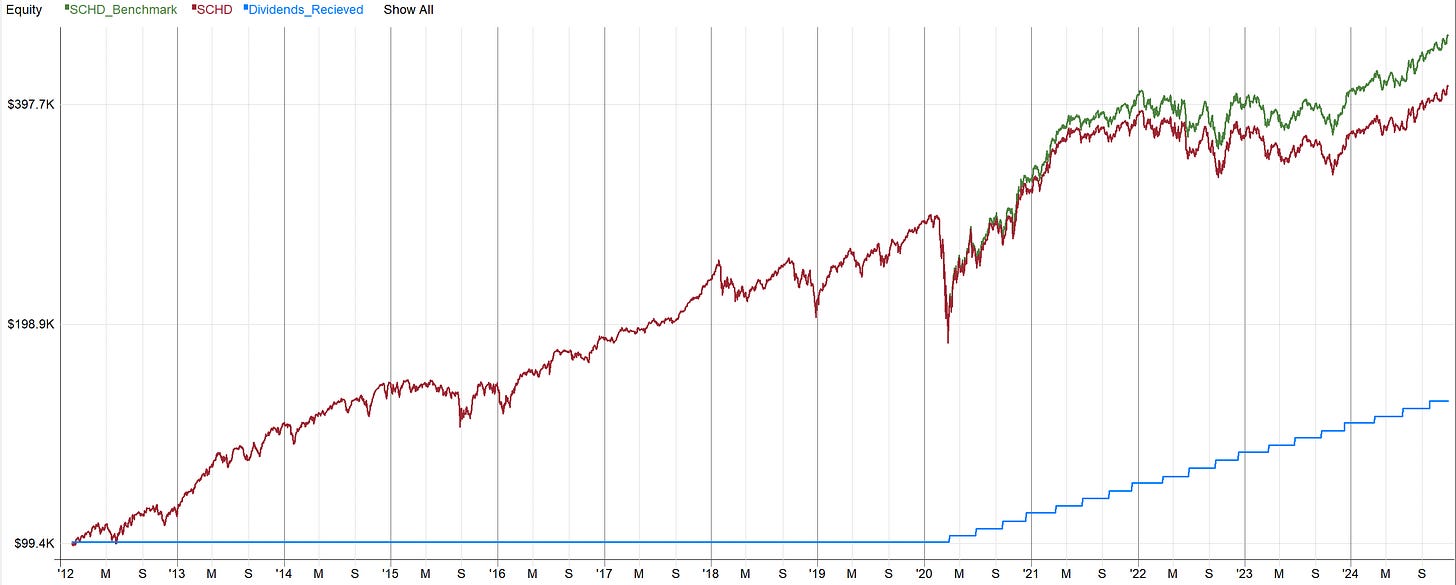

Now let’s move over to the dividend investor who lives off the dividend payment and does not sell any shares. Sadly, I cannot find a high dividend paying ETF that goes back far enough to make this same comparison like I did with SPY above. So what I did was use Coca-Cola stock “KO” as a replacement since they have been around and paying dividends for years. I am running this simulation with a starting balance of 2 million in KO and the investor takes the dividends out to use as income but never sells any shares.

Green Line: Coca-Cola total return with dividends reinvested (used as a benchmark)

Red Line: Investors return (living off the dividends and not reinvesting them)

Blue Line: Cumulative dividends received

The red bars in the plot above show the amount of money in dividends received each year. You can see that dividend payments are consistent and have increased over time (though this isn’t necessarily guaranteed). For the first few years there may not have been enough dividend income to sustain the retiree, but after awhile the dividend payments grew to be even more than what the retiree needed, which in nothing to complain about! The retiree could then take that extra dividend income and invest it back into Coca-Cola (or preferably diversify into another stock/ETF) to boost the stock returns and dividend payments even more.

This simulation is actually much more extreme than the simulation where we sold SPY shares for income. Coca-Cola had a massive 6 year bear market after 2000, then another during 2008. It’s also worth noting the compound annual growth rate (CAGR) of Coca-Cola was only about 5% from 1999 to today. Whereas the CAGR of SPY from 1999 to today was about 8%. If the Coca-Cola example didn’t have such a horrific bear market for the first few years and had a return closer to SPY over this time period, then these dividend payments would be even more astronomical!

So, you can see how living off the dividends can have an advantage during bear markets especially, because you never have to reduce your position size and sell at a loss. This comparison with Coca-Cola has many limitations and assumptions, but I think it illustrates the point of how living off dividends can be beneficial to selling shares. Disclaimer, I am not recommending to buy Coca-Cola stock nor any other stock or ETF listed; and having a whole retirement portfolio in only Coca-Cola stock is pretty silly. Remember to do your own research.

One final benefit to owning high dividend paying stocks/ETFs is they generally have dividend payments that are consistent over time. During a bear market the dividend payment may decrease slightly because companies are trying to save money, but many times companies still pay the dividend on a consistent basis of quarterly or semi annually. Another thing to consider is stock prices can be erratic and they may bounce up and down and take awhile to make large gains. Consider JPM stock, over the course of almost 2 years the stock price bounced around but ended up at the same price. Meanwhile during that entire period this stock was paying consistent dividends. So, while you may have ended up break even during that time frame on the actual investment itself, you were paid a consistent dividend during that period, putting money into your pocket to spend on bills/expenses.

Summarizing all that up, dividends can be a great way to receive consistent cash flow on your investments even if those investments take a hit due to an adverse market in the short term. You don't have to sell any shares and therefore can keep the same cost basis and value of your investment. Dividends may also help you mentally as they are a way to consistently receive income payments and you don’t have to worry about the uncertainty of the markets.

Drawbacks Of Dividend Paying Stocks:

The benefits of dividend investing seem pretty sweet but they do come with some drawbacks. Dividend paying stocks tend to experience less stock price growth overtime because they are not reinvesting the money back into themselves but rather giving payouts to the investors. Another thing to consider are tax implications. When you are paid a dividend it's not just free money, you have to pay taxes, at least in US jurisdictions. That may be fine for someone who currently lives off of their investment portfolio because whether or not you live off the dividend based portfolio or sell shares for income, you have to pay taxes either way. But if you are younger and still building up your portfolio and your portfolio is full of dividend stocks, you may be hindered by tax payments (unless of course you are using a tax advantage account like a 401k or IRA, but I am going to assume that is not the case).

Let’s consider an example. Say we have two investors who are 30 years old and are currently trying to build up their investment portfolio to retire off of one day. Say investor 1 buys a growth tech stock that does not pay dividends while investor 2 buys a stock that pays high dividends and he reinvests the dividends back into the stock when they are paid (he doesn't need the dividend payments now, instead he wants to compound the growth by reinvesting the dividends). Now assume that investor 1 makes 20% on their stock purchase and investor 2 also makes 20% (with dividends reinvested). You may think both investors end up in the same place just by different methods, and they did in essence. The main difference comes down to taxes. Investor 1 still holds all the shares that are now up 20% so they don't have to pay any taxes yet because they haven't yet realized that gain. Investor 2 has also not sold their shares but they have received dividend payments, and even though they reinvested those dividend payments they still have to pay taxes on those payments. So assuming investor 2 is setting money aside for taxes come year end, with every dividend payment he receives he's only able to reinvest around 80% of the dividend (assuming he owes 20% in taxes, this will vary depending on household income and local tax codes). Since he can only reinvest part of the dividend because some of it is being held for taxes, that means he didn’t actually make 20% on the investment like investor 1 did, because investor 2 was held back by the friction of taxes.

Furthermore, after 20 years say both of the investors in this scenario sell their position and then have to pay taxes on their capital gains. Assume again that both investors have to pay 20% in taxes on their gains. Investor 1 only had to pay taxes once, when they sold the investment after the 20 year period. Investor 2, on the other hand, had to pay taxes multiple times, when they sold the final investment after 20 years and on every dividend they received throughout that 20 years. Essentially investor 2 ended up paying more taxes than investor 1.

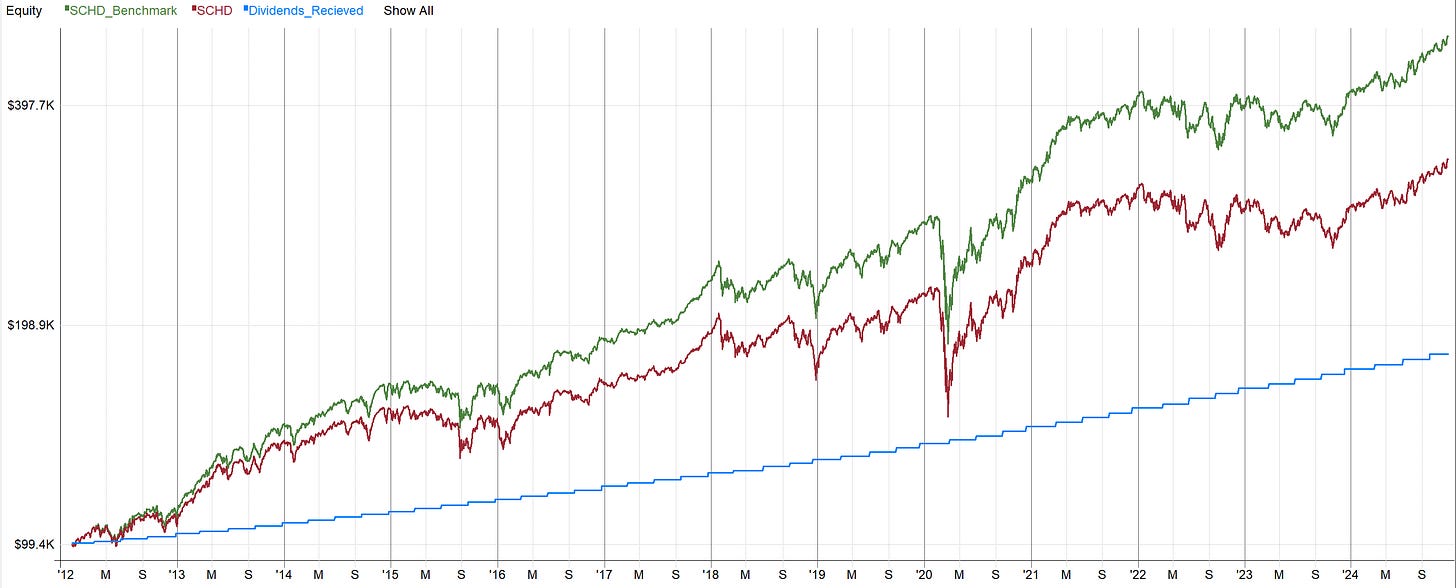

Let’s illustrate something similar to this example over many years. Below is the SPY ETF and SCHD ETF. The SPY ETF pays some dividends, but the SCHD pays much more in dividends. In this simulation any dividends received are only 80% reinvested to save some cash for tax season. We can compare this to a perfect world where reinvested dividends are not taxed and 100% of the dividend is reinvested.

You can see the returns which account for taxes on dividend reinvestments really put a drag on the account compared to a perfect world where dividends are not taxed. You can also see how the higher the dividends, the more drag you have because you have to pay more in taxes.

In my eyes, I see dividend investing for those who already have a sizable portfolio. Once the portfolio is big enough, then the dividend payments may be substantial enough to live off of, or at least partially live off of. If instead you have a small portfolio, the dividend payments may not be of significant value to live off of. So the small portfolio will face the drag of having to pay taxes along the way with each dividend payment, even if the dividends are reinvested (unless of course you use a tax advantage account, in which case receiving and reinvesting dividends is not really a disadvantage anymore).

Situational Examples:

The pros and cons that I outlined above may make it difficult to determine if dividend investing is right for you. So, what I will do is lay out a couple situations to show how each performs over time. This will allow you to get a better understanding of how different scenarios may play out.

To keep things simple in these scenarios, we will use the historical results of buy and hold SCHD (high dividend paying ETF). SCHD will be the investment vehicle in all of these scenarios but the situation for each of these scenarios will be a little bit different so you can see how they play out over time.

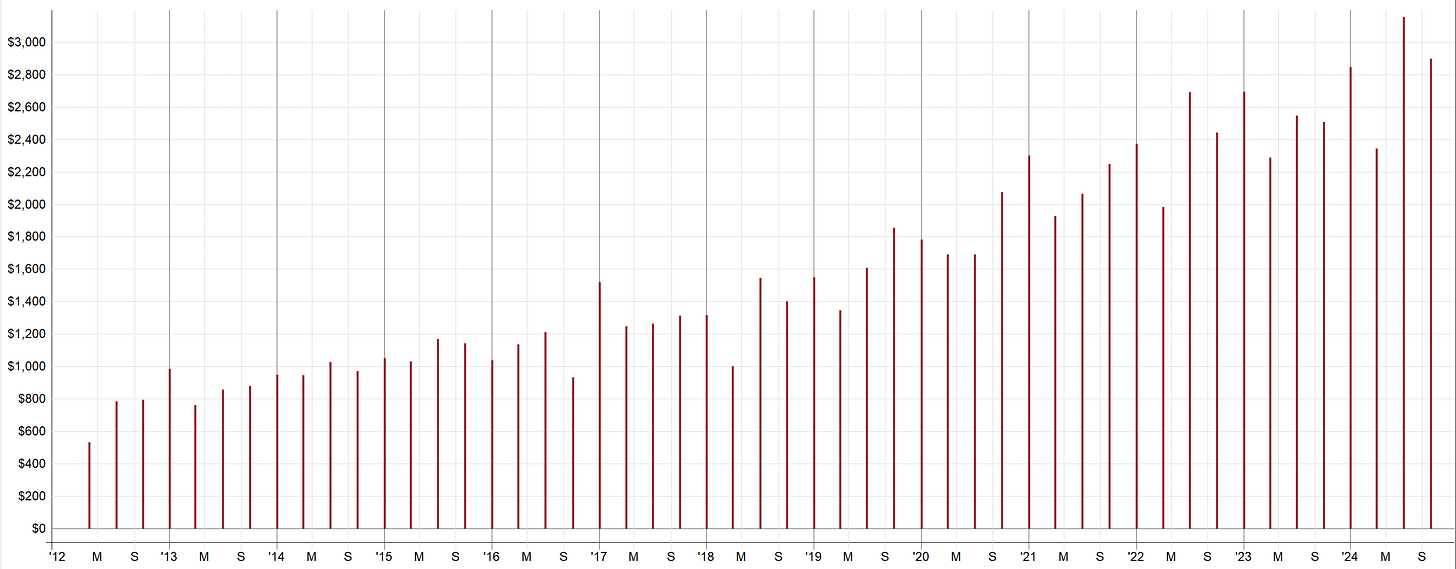

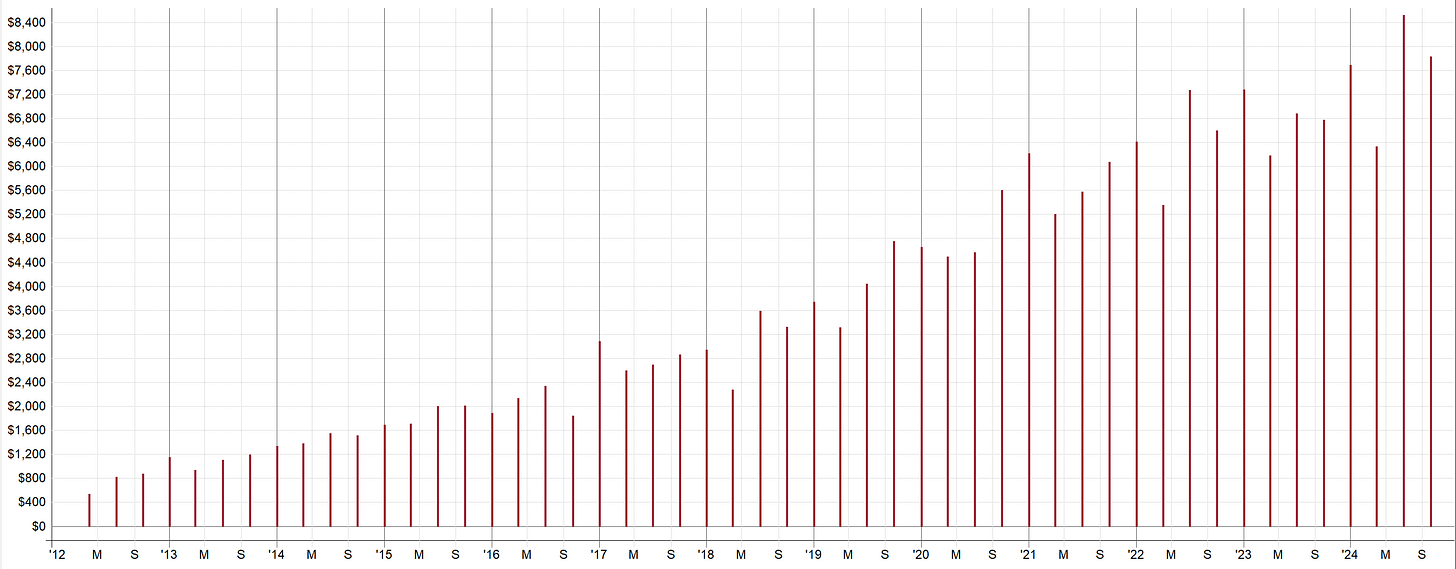

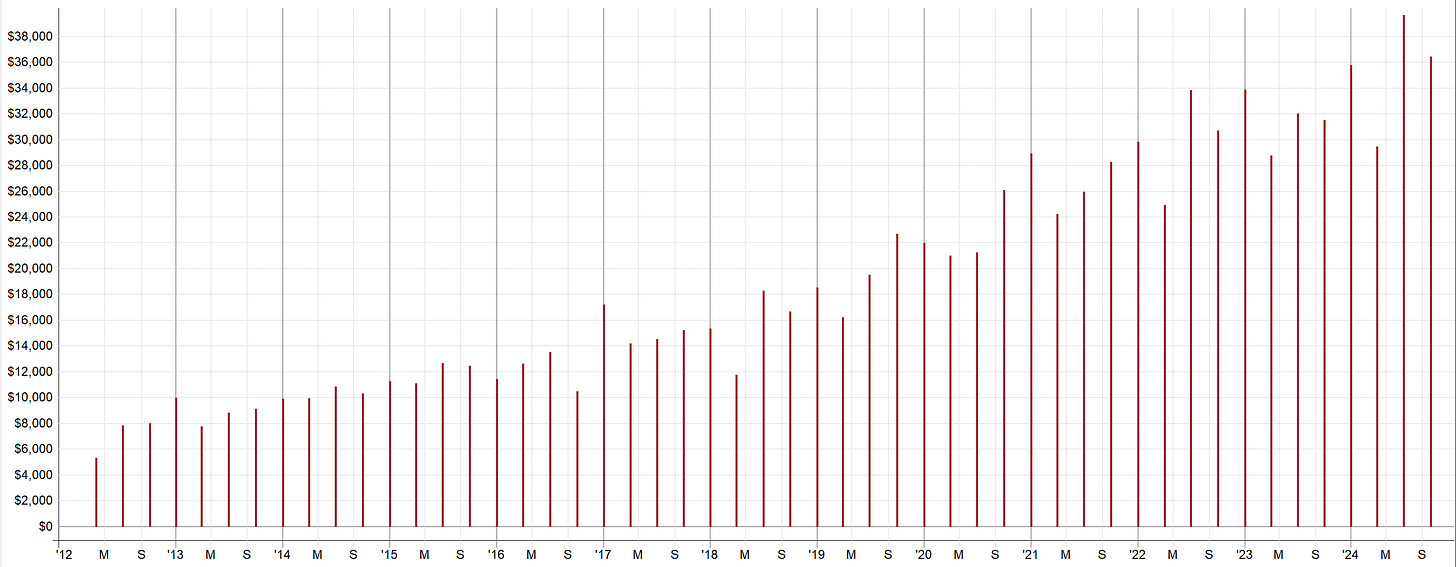

The first plot in each scenario will show one line of SCHD returns with dividends reinvested (green) and another line of SCHD returns with dividends taken out as income starting at some point in time (red). The blue line will show the cumulative dividends received over time to live off of. The second plot will show the amount of money received from each dividend payment each quarter.

Scenario 1:

Starting Account Value: 100k

Account Additions: $0

Time Invested Until Taking Dividends: 8 years

(these dividends were reinvested up until 2020, 2020 is the start of when dividends were used as income)

Scenario 2:

Starting Account Value: 100k

Account Additions: $0

Time Invested Until Taking Dividends: 0 years

(these dividends were used as income from the beginning)

Scenario 3:

Starting Account Value: 100k

Account Additions: $1,000 per month

Time Invested Until Taking Dividends: 8 years

(these dividends were reinvested up until 2020, 2020 is the start of when dividends were used as income)

Scenario 4:

Starting Account Value: 100k

Account Additions: $2,000 per month

Time Invested Until Taking Dividends: 8 years

(these dividends were reinvested up until 2020, 2020 is the start of when dividends were used as income)

Scenario 5:

Starting Account Value: 1 million

Account Additions: $0 per month

Time Invested Until Taking Dividends: 8 years

(these dividends were reinvested up until 2020, 2020 is the start of when dividends were used as income)

Scenario 6:

Starting Account Value: 10k

Account Additions: $1,000 per month

Time Invested Until Taking Dividends: 8 years

(these dividends were reinvested up until 2020, 2020 is the start of when dividends were used as income)

Conclusions:

Dividend paying stocks/ETFs can be a great tool for passive income when used properly. On the other hand, selling shares can also be a good way to earn passive income but comes with the risk of large losses during prolonged bear markets. Living off dividends allows you to keep the same cost basis and not sell for a loss during bear markets. If you plan to reinvest dividends, be sure to account for tax implications or do it in a tax advantaged account.

Thanks for reading! Hope you enjoyed this article. I had never really considered any of this stuff until I really took a deep dive into it. This article made me understand dividend investing a little more and hopefully it did for you too. There are many limitations to the examples I have shown and tax implications will be different for everybody. It’s also possible something I said was incorrect or not fully explained because I was learning about this topic as I wrote the article. So if you are considering a dividend investment strategy, I would encourage you to work all this out yourself using your own assumptions. Let me know if you need any help doing that. I’ll see you next time!